FXbeacon: 75 Hard, 100% Smart: Currency Hedging Lessons from my “75 Hard” Journey

Imagine at the beginning of July, you decided to join me on a personal journey to transform physically and mentally by taking on the “75 Hard” fitness and mental wellness challenge (I started 66 days ago). For those who are not familiar, “75 Hard” consists of 5 daily challenges:

A) Two 45-minute workouts (one has to be outside)

B) Stick to a diet of your choosing (no alcohol and no cheat meals)

C) Drink a gallon of water each day

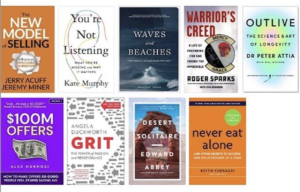

D) Read 10 pages of a non-fiction book, bonus rule

E) Take progress pictures

If you skip a day, you start over. Throughout the process each day, I wake up knowing that I’ll face grueling workouts, mental toughness exercises, and strict discipline requirements.

Meanwhile, in the business world, many companies are navigating their own set of daily challenges, much like the hurdles I’ve encountered on my journey. Surprisingly, there’s a striking similarity between a commitment to “75 Hard” and a business strategy called, hedging. Hedging or protecting against/mitigating risk, in the land of currency exchange uses the same principles of resilience and adaptability you need to complete “75 Hard” and each is equally vital for businesses seeking success in an unpredictable world.

Think about how important your health is to you. That headache that lasted a little too long, that cramp in your calf, the lower back pain that keeps you from sitting in certain positions. People regularly spend hundreds of thousands of dollars on their physical health. If you ask anyone over the age of 70 if they would rather have the health they had in their 20’s or a few million dollars they will unanimously choose their health. We can all agree that the financial health of a company is just as important to the longevity of that business, as physical and mental health is to mankind. By hedging, businesses are able to reduce the effect of adverse market movement, such as fluctuations in interest rate differentials or currency exchange rates, similar to the way mental and physical exercise combat the adverse effects of aging. By doing so, these companies can safeguard their profitability and long-term viability.

So far, I’ve learned that the daily consistency required by “75 Hard,” has created both physical and mental predictability in my life. Although challenging, I know what to expect each day. Without that predictability and routine, there is no way I would have been able to make it this far. Almost identically, hedging strategies provide businesses with stable financial footing by minimizing volatility and eliminating a variable from their business. This stability is crucial for effective planning and decision-making, enabling companies to pursue their strategic and FP&A goals with far greater confidence.

Although predictability is the ultimate goal, nothing happens exactly as planned. Because of the unpredictability that life has around every corner, “75 Hard” also emphasizes adaptability. By requiring participants to complete their daily tasks, rain or shine (my run in southern California during Hurricane Hillary can attest to that,) it forces participants to stay nimble in the face of uncertainty. Similarly, businesses need to have the ability to adapt to shifting market conditions. Hedging allows them to respond to unexpected changes by providing at least one concrete aspect of the business as a safety net that cushions the impact of adverse events. This protection ensures that companies remain agile in a dynamic business environment. Locking into metaphorical sunshine for the foreseeable future. Kiss those rainy runs goodbye.

Every day, companies invest significant resources in various projects and operations. Wouldn’t it make sense for these same companies to do everything in their power to protect those investments? Hedging their currency exposure safeguards these investments, ensuring that they yield returns even in unfavorable circumstances. The ever-changing economic markets become a nonfactor. In the world of business, competition is fierce and companies that hedge effectively can gain a competitive edge over their rivals by reducing their vulnerability to market fluctuations. This allows them to focus on strategic growth rather than reacting to external crises.

Doing the physical part of “75 Hard”

Doing the physical part of “75 Hard”In the same way that I’ve committed to diet, exercise, and mental improvement over the past 66 days, businesses need to demonstrate the same discipline if they stand a chance at surviving our current market. It’s crucial to manage risk so that regardless of the uncertainties that may arise, these companies are protected. Lifting weights, going on hikes and runs, and daily reading have cultivated the necessary mental toughness, teaching me to push through discomfort and setbacks. This has better prepared me for the unpredictable challenges that life throws my way. In a similar sense, companies that hedge are better prepared to withstand economic downturns, emerging stronger on the other side.

Both “75 Hard” and foreign currency hedging require long-term perspective. Short-term sacrifices that I’ve made each day have led to long-term gains in my personal fitness and learning. In the same way, in order to help secure a company’s long-term financial success, they must practice delayed gratification. Make small sacrifices now, and reap huge rewards later. By taking time now to consider and protect against potential risks over time, companies are protected from whatever the market throws at them.

Throughout “75 Hard,” I have strived for continuous improvement in the same way that most businesses do who work with GPS. This improvement mindset is such an important piece to the equation in order for companies to refine their hedging strategies and learn from past experiences to be better equipped to protect their assets and investments.

The correlation between hedging in the business world and the principles behind the “75 Hard” regimen, although unorthodox, is striking. These similarities emphasize a strong connection rooted in discipline, resilience, adaptability, and a forward-thinking approach. Just as individuals take on the “75 Hard” challenge to cultivate physical and mental fortitude, companies adopt hedging strategies to safeguard their financial stability and mitigate FX risk. Embracing these fundamental principles can empower both individuals and organizations to increase their odds of success while navigating the unpredictable twists and turns that life and the business landscape invariably present.

Learn more about GPS Capital Markets’ FXpert platform, awarded as “Best System for Assessing Risk and Hedging Strategy” by Global Finance. Visit the GPS website with more information here: GPS Awards