FX Market Brief: January 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-Area: “Q1 cut?”

- The European Central Bank is now done with its hiking campaign with the current deposit rate at 4% – underlying inflation is smoothing, and the headline print is lowering towards the 2% target. Additionally, activity surveys across various sectors show a significant deterioration and diminishing credit availability.

- Markets are seeing inflation decrease through this year and to reach 1.6% by January 2025, and roughly 1.5 percentage points of cuts by year-end are priced in. The first cut is priced for the April meeting, but some still favour the first cut in March (current probability at ~39%). The ECB, rather than the Fed, is cautious whenever the word “easing” is mentioned, which can translate into a delay in starting the easing cycle, meaning the pace of cuts could be faster.

- Headline CPI for December advanced to 2.9% YoY (vs. 2.4% prior).

- The region now flirts with the first recession since the pandemic, and the turning point now is where the euro-area is heading: a soft landing or a hard one due to the high borrowing costs, which could trigger ECB’s imminent action to change monetary policy earlier than planned.

| Date | Country | Economic Release |

| 17- Jan-24 | Euro-Aggregate | CPI YoY and MoM for Nov |

| 24-Jan-24 | Euro-Aggregate | Eurozone PMI Data (Manufacturing, Services and Composite) |

| 25-Jan-24 | Euro-Aggregate | ECB Rate Decision |

| 30-Jan-24 | Euro-Aggregate | GDP QoQ & YoY |

United Kingdom: “Last to cut?”

- Members of the Monetary Policy Committee kept rates unchanged at the December policy meeting, with Governor Andrew Bailey saying that the BoE is taking a “more cautious” stance on interest rates than markets. He continues to suggest that it is too soon to consider a policy pivot, deciding to keep the key interest rate at 5.25% in the final meeting of 2023.

- The UK enjoyed another below-consensus inflation report, with November’s Core CPI YoY rising 5.1% against an estimate of 5.6% and the headline coming in at 3.9% against an estimate of 4.3%.

- There is now some suggestion that the BoE may need to pare back its ‘higher for longer’ message, which contrasts with the more dovish rhetoric from both the Fed and the ECB.

- The UK suffered a minor recession during the second half of last year; however, the outlook is looking more favourable at the start of the new year, with the growth picture starting to brighten. Markets are currently pricing up to five quarter-point interest rate cuts from the MPC, with the first move coming at the June policy meeting.

| Date | Country | Economic Release |

| 16-Jan-24 | UK | Jobless claims and average earnings for Dec |

| 17-Jan-24 | UK | CPI and PPI for Dec |

| 19-Jan-24 | UK | Retail Sales for Dec |

| 24-Jan-24 | UK | Services, Manufacturing & Composite PMI for Jan |

United States: “Not In a Rush.”

- The Federal Reserve has ended one the most aggressive tightening campaigns in forty years, with Fed Chair Jerome Powell and his fellow colleagues acknowledging the need to cut rates in 2024 but that they will proceed carefully and closely monitoring any improvements in price pressures as well as other relevant indicators.

- Headline CPI for December ticked higher than the consensus, rising to 0.3% MoM (vs. 0.1% prior), and the YoY number advanced to 3.4% (vs. 3.1% prior). The core print remained at 0.3% MoM and YoY; core inflation fell to 3.9% (vs 4.0% prior). This data came in as a threat, leaving many analysts wondering if the market has priced in too much too soon from the Fed.

- Traders have now priced at least six 25 basis point interest rate cuts by the end of the year, with some favouring the first rate cut as soon as March (current probability at ~76%) and others only expecting for that to be in April.

| Date | Country | Economic Release |

| 16-Jan-24 | US | Empire Manufacturing |

| 17-Jan-24 | US | Retail Sales Advance MoM for Dec |

| 17-Jan-24 | US | Industrial Production MoM for Dec |

| 19-Jan-24 | US | U. of Michigan Sentiment |

| 24-Jan-24 | US | S&P Global US PMIs |

| 25-Jan-24 | US | Core CPE Price Index for Dec |

| 25-Jan-24 | US | GDP Annualized for QoQ |

| 26-Jan-24 | US | Personal Income & Spending for Dec |

| 31-Jan-24 | US | FOMC Rate Decision |

| 31-Jan-24 | US | ADP Employment Change |

CURRENCY PAIRS ANALYSIS

EUR/USD

- On EUR/USD the momentum remains bearish, especially as the outlook for the euro area looks more daunting than the US’, leading the pair to close last month on red. We have dropped quickly from the 1.10’s to trade below 1.08, and we have been consolidating around this level. The market is trying to push the pair to remain above 1.08 and head towards the next region of 1.09, where we find the imminent resistance around 1.0920.

- First resistance sits at 1.0920, followed by Key resistance at 1.1065.

- First support sits at 1.0755, followed by key resistance at 1.0660.

- The path for the pair is uncertain as we enter the new year. Besides economic data and growth, much will depend on who cuts rates first, the Fed or the ECB, and economists expect it to be a close call.

Source: Bloomberg

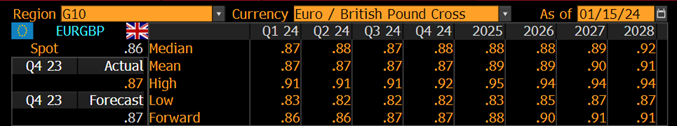

EUR/GBP

- Trading the cross has become a choice of which of the two economies is less weak. Growth is fragile, and while the core print in the eurozone continues to trend lower, the UK’s metric continues to be sticky. This should keep the BOE on its toes and wait longer to deliver any cuts, which should support sterling in the upcoming weeks. Any rally on the pair should be short-lived.

- Euro-Sterling advanced throughout December, but it peaked at 0.8714 (Dec’s high) and dropped to 0.8587, following better-than-expected MoM UK GDP. This move has brought into play December’s low of 0.8550, should a break of 0.8587 happen.

- First resistance sits at 0.8620, followed by key resistance near 0.8700.

Source: Bloomberg

GBP /USD

- The pound remains well supported against the US dollar, with cable trading towards the top of its recent trading range after failing to hold gains above 1.28, recorded towards the end of December. The improved UK has been supportive of sterling. However, investors remain nervous about building long positions, preferring to buy the pound on dips.

- Support levels to watch are 1.2610 ahead of 1.2540, with a breach suggesting a further attempt towards 1.22.

- First resistance sits at 1.2730 ahead of 1.2830, which was recorded at the end of last month.

Source: Bloomberg

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.