Case Study: Top International Architecture Firm Cuts a 7,500 Invoice Backlog with GPS

One of the world’s foremost firms in the Architecture, Engineering, and Construction industry partnered with GPS to clear a severe backlog of intercompany invoices and burgeoning FX risk exposure. Process improvements and analytics led to effectively mitigating FX exposure to optimal levels, leading to lasting satisfaction with GPS and the FXpert® platform.

CLIENT PROFILE

The client is one of the largest firms in their industry, operating in 17 countries worldwide, with clients in more than 100 countries and trading 15 currencies.

INDUSTRY

Architecture, Engineering, and Construction

ANNUAL REVENUE

$1.5 billion

THE CHALLENGE

As an international leader in their field with a complex system for resolving payments between subsidiaries, the client faced a severe backlog of open intercompany invoices spanning more than five years. The internal Treasury team struggled to address the issue on top of daily tasks, leading to increasing FX exposure risk as time passed. Overwhelmed by the thought of needing to complete hundreds of individual settlements through bank wire and FX trades, they searched for a partner who could conduct a thorough analysis of their existing systems, resolve the backlog, and implement efficient processes to streamline all of their future FX activities.

THE SOLUTION

Initially, the client had no formal hedging program and relied on cumbersome individual bank transfers. FXpert analytics allowed back-testing which paved the way for executive approval to overhaul their international payment system.

- Unclear FX exposure was a pressing issue. FXpert gave the client instant visibility into their risk profile leading to increased confidence and better FX-related decisions.

- The GPS Quantitative Risk Analysis (QRA) team delved into these open intercompany AR/AP invoices, systematically reducing FX exposure.

- Despite a small and centralized treasury team, the client was able to handle complexities through FXpert’s features like pre-settlement review and post-netting settlement report.

- The client now manages their cash flow effectively down to the subsidiary level thanks to the settlement review features of FXpert.

RESULTS

What the client has to say about FXpert’s Intercompany Netting Tool:

1. We value the ease of settling one or two small invoices that would have otherwise been aging as we waited for more invoices to combine into a reasonable amount.

2. The frequency of settlement for most entities prevents us from accumulating aged invoices.

3. We’ve seen a large reduction in the number of bank fees ICO accumulating across the entities.

CONCLUSION

With FXpert, the client was able to upload their invoices and gain invaluable insights into their risk profile. The platform’s user permissions, controls, and audit capabilities allowed them to manage their cash flow effectively, even down to the subsidiary level, alleviating strain on their centralized Treasury and Accounting teams.

Today, the relationship between the client and GPS has evolved to improve other areas of their treasury systems and create a better working environment for their treasury employees. The data analysis, reporting, and automation features that FXpert provides continue to refine their treasury processes.

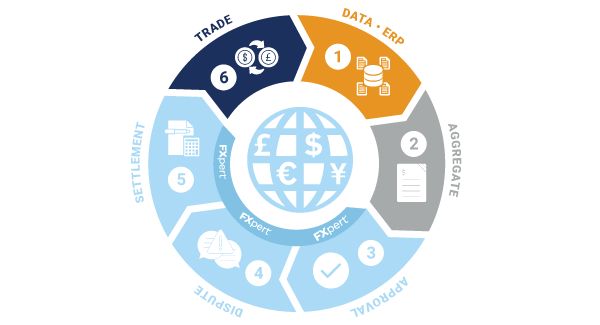

AUTOMATE CHALLENGING MANUAL PROCESSES

- Standardize regular processes and accounting reporting with the FXpert platform.

- Aggregate data about your past FX processes and use insights to optimize decisions for the future.

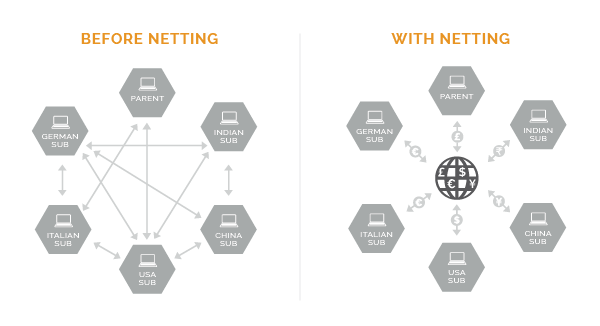

- Simplify your view of intercompany FX dynamics and produce a single payment/receivable in each subsidiary’s local currency.

For an analysis of your exposures and currencies mentioned in this client case study, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.