Interconnected Markets and Cash Flow Hedging Agility

Each morning, as I walk through the GPS headquarters in Salt Lake City, breaking news plays on flatscreens lining the area where account executives and other members of the GPS team work. Whether it’s a natural disaster, international conflict, or trade agreement, being in an FX company will make you believe that a butterfly flapping its wings in South America could really cause a storm in the northern hemisphere. Breaking news flashing across screens can start a domino effect, with account executives checking reports, looking up currency movements, or getting on the phone to talk to cash flow hedging and other clients who might be impacted by events.

When I was a college and graduate student studying cultural anthropology, every spring I applied for grants that would help me do fieldwork abroad. With a longtime love of cross-cultural exchange and the growing possibilities of big data, I started focusing on what’s called Network and Complex Systems Theory, which uses mass data gathering and visualization techniques to study underlying patterns in different systems, which could be economic, as we’re focused on at GPS; ecological; social; and more. Besides studying interconnected data points, just traveling between my home in Utah and Europe provided me with a fascination for the way trends spread and impact events in (sometimes) predictable ways.

Today, it’s exciting to work in a field where I see the contemporary world’s interconnected nature daily—like having a finger on the pulse of a complex network of investing and divesting, growth and absorption. Seeing the proactivity and how detail-oriented the multi-person teams supporting our clients are also inspires me. Especially during the past year, unforeseen conflicts and shifting trade agreements (see All Eyes on the Peso by Michael Buck) create ripples and test GPS’ ability to predict and respond on the dot when market disruptions occur. While nobody has a crystal ball, cash flow hedging can anticipate and obviate losses.

Examples of how businesses increase agility with cash flow hedging

For companies of any size, foreign exchange exposure can increase operating costs, cause cash flow and balance sheet discrepancies, or increase anxiety about the value of assets and liabilities. To better understand how GPS teams assess cash flow exposure and provide agile solutions as events occur, the following provides specific examples of scenarios that required quick pivots of cash flows due to war, subsidiary closure, and more.

Many examples show how GPS clients utilize hedging advice when unforeseen events take place and can illustrate the benefits of person-to-person collaboration that takes place in cash flow hedging programs.

- After working with GPS to trade and hedge multiple European currencies, one GPS client decided to close one of their subsidiaries due to political changes in the country where they had a subsidiary located. The client had a mature hedging process in place for the currencies in the EU market and was faced with trying to unravel the strategies and determine the best time to exit based on market factors. Their dedicated GPS account manager and team provided forecasting and advice to determine the best way to unwind existing hedges, protecting cash flows and alleviating the burden on their treasury department. Although you may think cash flow hedging only applies when you’re building a program, having expert advice as you are reworking or dismantling is just as important.

- One client had worked with GPS to trade and hedge in Europe and as their company grew, decided to invest in an Asian entity and begin trading in Japanese and Chinese yen. As they investigated these business development opportunities, GPS was there to forecast and give advice based on data aggregated from other clients in the sector over the years. GPS helped their treasury team set up their APAC operations, contributing significantly to their scaling up. Whether adding currencies or changing regions of the world where companies are doing business, GPS facilitates business evolution.

- When the wars in Ukraine and Israel ramped up in the past few years, GPS clients across the board saw huge fluctuations in multiple currency value. While the Israeli shekel went up in value, a much more unforeseen event was the rapid devaluing of the Mexican peso, as large US companies spooked by the global turbulence pulled their investments from below the border. GPS advisors closely monitored currency pairs and were in touch daily as markets began to move in radically different directions.

How cash flow hedging works

When companies set up cash flow hedging processes, forecasting cash flows starts 12 months in advance. This process allows business to lock in better rates, providing certainty about the actual cost of expenses and liabilities.

When a business implements a cash flow hedge, the use of a hedging instrument (a derivative) locks in the amount of a future cash inflow or outflow before market volatility hits. Cash flow hedge accounting then connects the income statement of a hedging instrument and a hedged transaction, offsetting the predicted changes in cash flow.

Matching cash flows to offset losses due to currency market volatility, the change in the value of the derivative designated as a cash flow hedge will be reported as a component of other comprehensive income (OCI) and then reclassified into earnings in the timeframe when a forecasted sale or debt happens.

Different types of cash flow hedging strategies

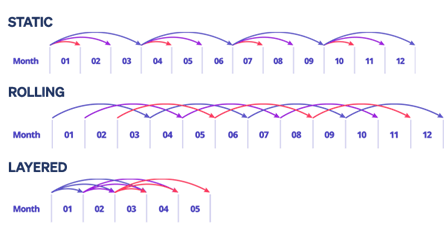

There are three main types of strategies to offset forecasted cash flow issues: static, rolling, and layered.

Common cash flow hedging strategies

- A static hedge does not need to be re-balanced as the price of other characteristics of the securities it hedges change. One of the most common types of static hedge is a forward contract. Most futures traded on exchanges are settled on the day they expire, rather than delivering the underlying asset.

- Rolling hedging strategies involve buying and selling futures contracts as they expire. These hedges are monitored and adjusted to determine if the hedge is still effective. As futures expire, treasury teams evaluate whether to roll over the hedge or exit the position. Rolling over the hedge means selling the expiring contract and buying a new one, while exiting the position means closing the hedge altogether.

- With a layered hedging strategy, your hedge rate is built in advance. Hedges apply in progressive layers, so completely accurate forecasts aren’t necessary. With this strategy, CFOs and treasury professionals can shift interest rate differentials and cash flow visibility to smooth out and lower the variability of company cash flows.

The benefits of dedicated customer service while hedging cash flows

The above examples show that conducting international business comes with multiple opportunities and challenges that many treasury departments struggle to manage if they are relying on individual banks. Yes, GPS beats bank rates and saves clients millions, but more importantly, advisors provide 24/7 attention to each client, getting to know their business needs and anxieties inside-out.

Working in tandem with real experts in the FX space, clients get to engage in granular business development conversations on an ad hoc basis. If you find out that a supplier or payee in a subsidiary goes out of business, GPS will be there to give recommendations, shifting resources to other markets, or simply implementing different hedging strategies. If a war or international trade relationship shifts, GPS uses its large bank of data and its experts’ decades of experience to create plans to offset losses or win new contracts across unaffected markets.

Further reading: https://www.investopedia.com/ask/answers/050615/what-are-most-effective-hedging-strategies-reduce-market-risk.asp