FX Market Brief: June 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- The European Central Bank cut its three key rates by 25 basis points at its meeting on the 6th of June, as widely expected – with only one policy official preferring to leave rates unchanged. This decision was made despite the central bank raising its inflation forecast for this year and the next year by more than estimated.

- The ECB is confident of the path ahead for the economy and that is why it cut interest rates, adopting a forward-looking strategy for inflation rather than relying solely on spot inflation prints. Recent data has proven to be in line with the bank’s expectations, with fewer and fewer surprises.

- A “data-dependent and meeting-by-meeting approach” was underscored by Christine Lagarde and added that rates will still be restrictive for some time, not compromising for any further rate cuts. This approach led many analysts to consider this move on the borrowing costs as a “removal of excess monetary restriction,” and less of a drag for the euro-area economy going forward – a “hawkish cut.”

- Price pressures remain high, and wage growth remains a concern in keeping services inflation elevated. In the June statement, the ECB acknowledged that “wage growth is elevated” whereas in April it stated that “wage growth is gradually moderating,” stressing the marginally hawkish shift on wages and inflationary pressures.

- Lagarde did not specifically rule out the July cut as it is handy to have that option, but markets see it as off the table, given the ECB’s updated hawkish forecasts and press conference.

| Date | Country | Economic Release/Event |

| 18-June-24 | Euro-Aggregate | CPI YoY |

| 18-June-24 | Euro-Aggregate | CPI MoM |

| 18-June-24 | Euro-Aggregate | CPI Core YoY |

| 21-June-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 21-June-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 21-June-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

| 27-June-24 | Euro-Aggregate | M3 Money Supply YoY |

United Kingdom

- As expected, the BoE kept interest rates unchanged at the May policy meeting, however Governor Andrew Bailey suggested that the central bank might be starting policy easing soon. Nevertheless, the outlook remains uncertain with markets suggesting that a cut would not be expected until at least the August meeting – and possibly not until November.

- Inflation dropped to the lowest level since the summer of 2021, with YoY CPI for April rising 2.3%, down from 3.2%. However, the print was above consensus and showed that services inflation remains sticky, indicating that prices are not cooling as fast as the MPC may wish, suggesting that interest rates will not be cut imminently. The UK jobs market continues to cool however wage inflation remains an ongoing concern for the committee and markets will closely watch the May labour market report.

- The UK also faces the uncertainty of a General Election at the start of next month and if polls are accurate, voters will welcome a change in government. Whilst politics are unlikely to influence the BoE interest rate decisions, the market reaction to a Labour majority is expected to be muted with a small bias towards a stronger pound.

| Date | Country | Economic Release |

| 11-June-24 | UK | Jobless Claims Change |

| 12-June-24 | UK | Industrial Production MoM |

| 19-June-24 | UK | CPI YoY |

| 19-June-24 | UK | CPI MoM |

| 19-June-24 | UK | CPI Core YoY |

| 20-June-24 | UK | Bank of England Bank Rate |

| 21-June-24 | UK | S&P Global UK Manufacturing PMI |

| 28-June-24 | UK | GDP QoQ |

| 28-June-24 | UK | GDP YoY |

United States

- The Federal Reserve is expected to meet this week at the FOMC meeting on the 12th of June, where the key focus will be on the dot plot, which the markets are now expecting to signal two rate cuts this year.

- Nonfarm payrolls came in as a bit of a surprise, as well as the average hourly earnings, suggesting the slowdown registered in April’s data may have been temporary, rather than a long-term smoothening. This data should keep the Fed cautious and will make policy makers hesitant on rate cuts in the short-term.

- Headline NFP rose to 272,000 in May, versus a consensus of 180,000. The largest increase in jobs was concentrated in the jobs that had cooled in April, adding further proof that the April slowdown was temporary. Average Hourly Earnings accelerated to 0.4% in May, the fastest increase since the beginning of the year.

- Along with the Fed’s dot plot, CPI inflation will also be in the spotlight. CPI inflation is estimated to have decreased in May from prior 0.3% to 0.1%, and core inflation is estimated to be kept in line with the previous print at 0.3%.

- The Fed will likely keep rates on hold with minim al changes to the statements and economic forecasts, but things will be interesting around the dot plot, where many analysts suggest a hawkish shift – corresponding to only two cuts this year.

| Date | Country | Economic Release |

| 12-June-24 | US | U. of Mich. Sentiment |

| 12-June-24 | US | PPI Final Demand MoM |

| 12-June-24 | US | CPI MoM |

| 13-June-24 | US | CPI YoY |

| 13-June-24 | US | Retail Sales Advance MoM |

| 14-June-24 | US | S&P Global US Manufacturing PMI |

| 18-June-24 | US | Durable Goods Orders |

| 20-June-24 | US | U. of Mich. Sentiment |

| 21-June-24 | US | Conf. Board Consumer Confidence |

| 25-June-24 | US | GDP Annualized OoO |

| 27-June-24 | US | Durable Goods Orders |

| 28-June-24 | US | U. of Mich. Sentiment |

CURRENCY PAIRS ANALYSIS

EUR/USD

- Last week NFP data showed that the US economy is still holding on well, taking the euro off the 1.09 level to currently trade mid 1.07-1.08 and under the king greenback.

Traders have also factored a political risk premium to euro-zone assets after this weekend’s parliamentary elections showing a clear move to the right, which should keep option prices elevated for the next month. Implied volatility increased from 5% on Friday to 6% today, suggesting the euro could slip to lower levels around 1.06. - The trajectory for the pair continues to be driven mainly by the dollar side of the equation, even with current political events in the common area such as snap French legislative elections hurting the euro.

- Support: (S1- Key) 1.0650, (S2 – Key Support from 1Q23) 1.0520, (S3) 1.0450

- Resistance: (R1) 1.0920, (R2) 1.10

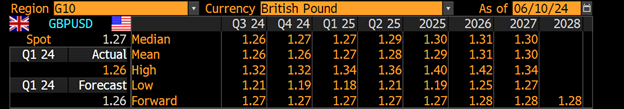

GBP/USD

- GBP/USD enjoyed a solid May and a good start to the month of June with the pair testing resistance at 1.28 several times in the past few weeks. The rally was more of a dollar move – with cable benefitting from the projection of interest rate cuts from the Fed being pushed closer to the end of the year.

- Cable followed EUR/USD lower after the solid US NFP release, dropping through support to trade in the low 1.27’s, but remains within its recent trading range.

- The outlook for both UK and US interest rates will likely be the main driver for GBPUSD in the coming months, however, the upcoming UK general election may influence the pair in the short term.

- Support: 2700, Key Support at 1.2665 and 1.2600

- Resistance: 1.2800 and 1.2850

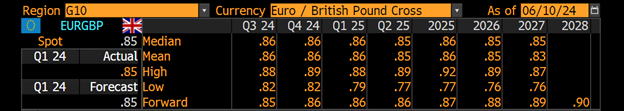

EUR/GBP

- The euro is 0.5% lower trading near 0.8450 as the sterling gains territory near historical lows. We believe this abrupt move mainly came from the retracement on EUR/USD post ECB and NFPs but also as President Emmanuel Macron called for parliamentary elections as his party was well defeated in the European elections.

- The pair is on track for lower levels, especially after the solid break of the key 0.8500 resistance and as political noise builds up.

- Support: (S1- Key) 0.8450, (S2) 0.84

- Resistance: (R1) 0.8645, (R2- Key) 0.87

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.