Case Study: International Entertainment Company Substantially Reduces FX Risk with GPS’ Cash Flow Hedging Expertise

An industry-leading international entertainment company with annual revenues of $900 million operates with a significant presence in over 20 countries, with the European group dealing with five currencies due to its inflows and outflows from operations. Despite their robust market position, the company struggled with managing currency fluctuations and forecasting cash flows accurately in their foreign exchange treasury operations. This difficulty impacted their ability to optimize cash flows across their international operations, which GPS helped address through cash flow hedging (CFH).

CLIENT PROFILE

Annual revenue: $900 million, presence: 20 countries; The European group deals with five currencies.

INDUSTRY

International Entertainment

THE CHALLENGE

Many multinational companies struggle with the timely conversion and delivery of local currencies to cover operating expenses of their foreign subsidiaries. The European region of this entertainment company had monthly expenses in five currencies: GBP, EUR, INR, RON, and PLN. Before partnering with GPS Capital Markets, the company relied on a complex and manual spreadsheet-based process that presented several challenges. They forecasted needs in USD rather than local currencies, struggled to keep up with changing market conditions, and faced delays due to communication and collaboration across time zones. Additionally, the lack of an institutionalized process led to confusion, particularly for a limited treasury headcount.

“We initially started FX advisory conversations with GPS in 2021 to look at ways to automate a very outdated, manual, Excel-based forecasting process. We were looking to take currency volatility out of the monthly need to deliver various local currencies to their respective subsidiaries in a timely manner,” the VP, Financial Controller of Europe said.

In addition, the company’s Western European Treasury Department lacked the internal bandwidth to implement and manage hedge accounting practices effectively. Hedge accounting requires expertise, detailed documentation, rigorous effectiveness testing, and compliance with GAAP and IFRS standards.

IMPLEMENTATION OF COMPREHENSIVE CASH FLOW HEDGING STRATEGY

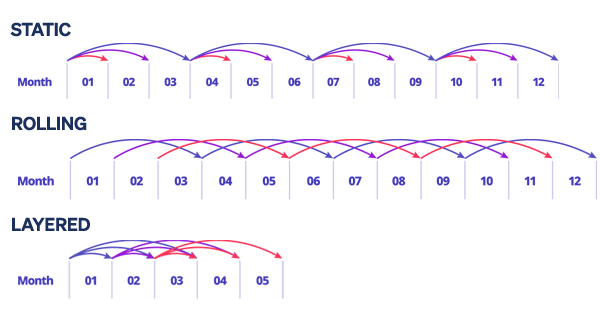

GPS Capital Markets quickly conducted a thorough assessment of the company’s risk exposure and potential strategies for protecting their cash flows. This involved utilizing derivative financial instruments such as forward contracts to hedge their currency risk. By implementing a layered hedging strategy, the company gained the ability to predictably manage their FX requirements and stabilize their financial forecasts.

“GPS worked with us to establish our program and guide us on how best to implement our hedging strategy, narrowing our program to several key currencies,” the client VP said. “FXpert’s Hedge Accounting system was of great assistance in the early stages of our hedging program.”

TECHNOLOGY-DRIVEN TREASURY MANAGEMENT

GPS’ advanced technology platform, FXpert, played a pivotal role in transforming the company’s FX treasury operations. The cloud platform offers visibility into cash flow exposures, automatically generates hedging recommendations, automates trade execution, and provides detailed reporting, enabling proactive risk management decisions.

Additionally, FXpert features like automated settlement workflows and built-in mirroring of company internal controls, provide compliant and streamlined processes that ensure accuracy and efficiency in treasury operations. The client stated, “FXpert is easy to navigate and allows us to manage our hedging strategy in multiple time zones at once.”

EXPERT ADVISORY SERVICES

GPS’ risk management expertise addressed their specific challenges with precision. GPS’s proactive approach and deep data analysis helped navigate foreign exchange complexities and mitigate financial risks. Their seasoned FX and quantitative risk professionals provided strategic insights and practical solutions, developing customized hedging strategies and ensuring compliance with global accounting standards. Leveraging advanced technology through the FXpert platform, GPS enabled the company to make informed decisions, optimize cash flow, and achieve financial stability.

HEDGE ACCOUNTING EXPERTISE AND COMPLIANCE

GPS provided extensive training and support to the company’s treasury team on hedge accounting principles and practices. This included guidance on documenting hedge relationships, assessing hedge effectiveness, and ensuring compliance with GAAP and IFRS standards. Through rigorous effectiveness testing, GPS ensured that the company maintained a compliant hedge ratio, achieving a robust hedge effectiveness rate of 90%. This not only provided financial stability but also enhanced transparency and accuracy in their financial reporting.

THE RESULTS

The collaboration with GPS Capital Markets delivered significant outcomes for the entertainment company:

PREDICTABILITY: By locking in exchange rates, the company achieved greater stability in cash flow management, minimizing uncertainties and optimizing financial planning.

COMPLIANCE: Achieved full compliance with GAAP and IFRS accounting standards for hedge accounting, ensuring transparent and accurate financial reporting.

AUTOMATION: Equipped the company’s treasury team with advanced knowledge and tools to effectively manage hedge accounting and mitigate financial risks proactively.

PARTNERSHIP: In this ongoing relationship, the client benefits from GPS’s trusted advisory services and impactful deliverables tailored to support their growth and success. GPS’s unique and bespoke approach provides scalable solutions for both big and small needs, making treasury management more efficient and effective no matter what the future holds.

“GPS saves our team time, as our dedicated advisors run models and manage with deep analysis, which allows us to assess our exposure in FX and actively manage our cash flow program in a timely manner. Their accounting services support us and save us a good deal of time and money with their care and attention,” the VP, European Financial Controller said.

WHAT’S NEXT?

The partnership with GPS did not only addressed immediate financial challenges, but also equipped the company with scalable and sustainable treasury management practices. Moving forward, they are poised to navigate global market uncertainties confidently, supported by robust financial risk management strategies and enhanced operational efficiencies. They’ve added currencies and markets in APAC, and GPS is growing and scaling with their expanding international business.

For an analysis of your exposures and currencies mentioned in this client case study, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.