Polling Insights: What’s Driving Currency Volatility and What’s Next for the Dollar?

Global currency markets have been anything but quiet lately, with some big moves catching the attention of our in-house experts at GPS and the wider community of FX enthusiasts and professionals who regularly weigh in on our polls. From the Swiss Franc’s 6% surge against the US dollar since June to GBPUSD’s steady climb, these shifts tell a story of market expectations around US interest rate cuts and broader global influences. While many expect the Fed to ease rates by year’s end, cautious moves could slow that process, potentially reshaping the current landscape.

As our team and community continue to analyze these evolving trends, all eyes are now on the US market, where critical data and expert insights are driving the conversation.

Spotlight on the Fed: What’s Next for Interest Rates?

Jerome Powell’s latest address had a surprisingly relaxed tone, hinting at the potential for further rate cuts as the year progresses. With markets already expecting a 1% reduction by year-end and just three meetings left on the calendar, anticipation is building.

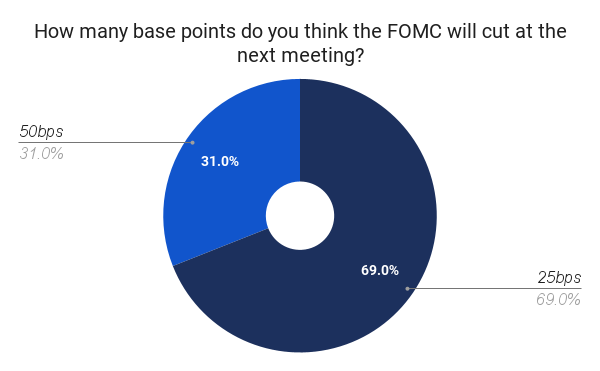

Our recent poll shows that while most market watchers expect a 25bps cut, there’s still some debate about whether the Fed might take a more aggressive approach. As the countdown to the next FOMC meeting begins, the focus will be on how these decisions impact the FX landscape and broader economic sentiment.

- 25bps: 69%

- 50bps: 31%

“With the potential upcoming interest rate hikes by the Fed, US-based businesses with FX exposure could face increased volatility and currency risk. Higher interest rates typically are Dollar positive, which can lead to reduced competitiveness for exporters and opportunity for businesses with foreign expenses,” said Amy Chin, VP Sales and Trading, North East at GPS. “I predict a 25 basis point rate cut may precede any hikes to ease into the shift in monetary policy, providing some short-term relief and a smoother transition for businesses to adjust their FX strategies accordingly. To navigate these changes effectively, businesses should leverage Orders to stay opportunistic and capitalize on short-term currency movements.”

“With the potential upcoming interest rate hikes by the Fed, US-based businesses with FX exposure could face increased volatility and currency risk. Higher interest rates typically are Dollar positive, which can lead to reduced competitiveness for exporters and opportunity for businesses with foreign expenses,” said Amy Chin, VP Sales and Trading, North East at GPS. “I predict a 25 basis point rate cut may precede any hikes to ease into the shift in monetary policy, providing some short-term relief and a smoother transition for businesses to adjust their FX strategies accordingly. To navigate these changes effectively, businesses should leverage Orders to stay opportunistic and capitalize on short-term currency movements.”

Navigating Market Turbulence: The Latest Shifts in FX and Economic Outlook

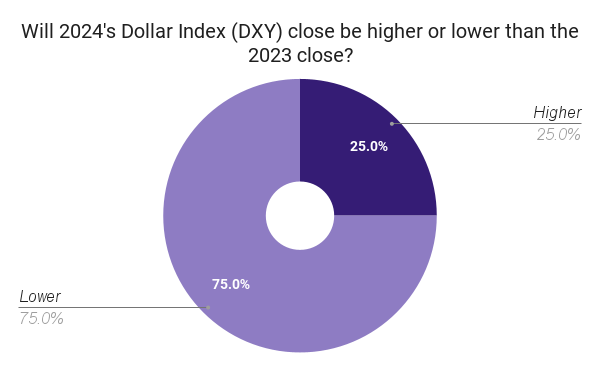

Currency volatility is a constant challenge for businesses operating across borders. As 2024 unfolds, we’ve seen significant movement in currency markets, including a Dollar Index that hovers near its lowest point of the year. With experts divided on whether the Dollar Index will end the year higher or lower, companies are left grappling with the implications for their bottom lines.

We asked our LinkedIn audience of FX and finance professionals:

- Higher: 25%

- Lower: 75%

This graphic shows the major currency spot returns against the dollar in August:

“The dollar’s biggest weekly gain is +4.35% vs. the Mexican peso. The peso’s decline (-19.72% vs. the USD since early April) began around the time of Mexico’s general election and has gained momentum with the unwinding of the carry trade, a dimming economic outlook for the US and uncertainty over the U.S. general election in November,” said Mark Allen, FX Trading and Derivatives at GPS.

“The dollar’s biggest weekly gain is +4.35% vs. the Mexican peso. The peso’s decline (-19.72% vs. the USD since early April) began around the time of Mexico’s general election and has gained momentum with the unwinding of the carry trade, a dimming economic outlook for the US and uncertainty over the U.S. general election in November,” said Mark Allen, FX Trading and Derivatives at GPS.

“The USDMXN carry trade (borrow USD at 5.25% and invest in the Mexican peso to earn 11.25%) has been a popular investment vehicle used by traders to get exposure to emerging markets. But traders have begun to unwind the carry trade,” Allen said.

Navigating FX Volatility: Insights from the Experts

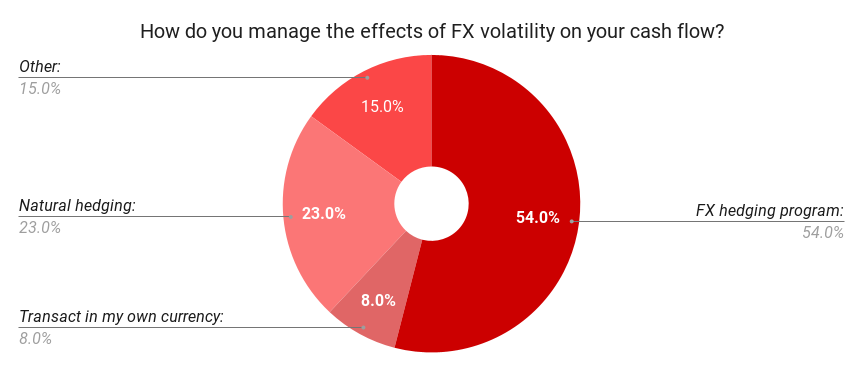

To better understand how businesses manage currency volatility, we conducted a poll on LinkedIn. The results showed that more than half of the respondents (54%) use a formal FX hedging program to protect against unpredictable market shifts, while 23% rely on natural hedging strategies. A smaller group (8%) chooses to transact exclusively in their home currency, avoiding FX exposure entirely, while 15% of respondents employ other methods.

- FX hedging program: 54%

- Transact in my own currency: 8%

- Natural hedging: 23%

- Other, please comment below: 15%

Recent Market Movements: A Closer Look

The global market landscape has been volatile, with events like Japan’s currency strengthening and geopolitical tensions impacting FX rates. A notable market reaction occurred on August 5th when the U.S. job market showed signs of weakness, leading to a 3% drop in the S&P 500 and a 3.4% decline in the NASDAQ. The Dollar Index dipped to 102.16, reflecting the broader uncertainty.

There were two catalysts that led to the August 5th market volatility: the Bank of Japan’s surprise rate hike on Wednesday, July 31st; and the August 2nd surprise drop Nonfarm Payrolls.

Allen explained further in August 28th’s US Market Brief, “Month-end flows have helped the US dollar recover from the previous week. DXY rose 0.2%, reducing its monthly decline to 2.1%. This is setting up the Dollar for its biggest monthly drop this year. Demand for generative AI products over the past year has fueled Nvidia’s growth.”

The Role of FX Advisors in Uncertain Times

The fluctuating market conditions underscore the importance of strategic FX management. According to our poll, 54% of businesses are proactively using hedging programs to protect their cash flow from adverse currency movements. However, it’s not just about having a hedging strategy—success lies in ongoing adjustments and expert guidance.

Preparing for Future Market Shifts

With 2024 shaping up to be a year of significant economic and geopolitical developments, companies need to remain vigilant. The unpredictability of FX markets requires not only a solid risk management framework but also the agility to adapt as conditions change. As polls suggest that most experts anticipate ongoing volatility, businesses must stay prepared.

Whether through hedging, strategic currency transactions, or other protective measures, companies can navigate the turbulent waters of FX markets with the right support and expertise. At GPS Capital Markets, our team is committed to providing that guidance, helping businesses safeguard their financial health in an increasingly uncertain global economy.

Looking Ahead

As we continue to monitor the economic landscape, one thing is clear: market conditions can shift rapidly. For businesses, staying ahead of these changes is essential to managing FX risk effectively.

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.