FX Market Brief: September 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- It has been a quiet summer for the European Central Bank after keeping interest on hold throughout the period, following a 25 basis points reduction at the June meeting. Markets were largely expecting the pause, with officials continuing a “data dependent and meeting by meeting approach” as underscored by ECB President Christine Lagarde.

- Wage growth remains a key focus for the central bank and recent data on pay suggests that it is moving in the right direction to allow for a further interest rate cut at the September policy meeting. Inflation data remains mixed, with both headline and core readings decelerating, however price increases for services rose to 4.2% in August from 4.0% in July.

- Overall, however, inflation has somewhat surprised slightly to the downside and markets expect this to be reflected in the latest forecasts to be published by the ECB’s staff economists.

- Officials have previously suggested a further cut of 25 basis points at the policy meeting on September 12, with unanimous support across the Governing Council expected. Markets currently expect a further reduction of the same magnitude in December, however the current concerns over the stickiness of services inflation are likely to refrain policymakers from committing into 2025.

| Date | Country | Economic Release/Event |

| 12-Sept-24 | Euro-Aggregate | CPI YoY |

| 17-Sept-24 | Euro-Aggregate | CPI MoM |

| 18-Sept-24 | Euro-Aggregate | CPI Core YoY |

| 18-Sept-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 23-Sept-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 23-Sept-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

| 23-Sept-24 | Euro-Aggregate | M3 Money Supply YoY |

United Kingdom

- The Bank of England delivered a 25-basis point interest rate cut at its policy meeting on August 1, taking the benchmark rate from a 16 year high, producing the first cut since the start of the pandemic in March 2020.

- Ahead of the cut last month, inflation had been moving in the right direction and on track to match the central bank forecast, however basing effects associated with household energy bills and stubborn services inflation continue to cause concern to rate setters.

- At the recent Jackson Hole symposium, BoE Governor Andrew Bailey remained cautious, saying, “we are not yet back on target on a sustained basis.” He added “policy setting will need to remain restrictive for sufficiently long until the risks to inflation remaining sustainably around the 2% target in the medium term have dissipated further. The course will therefore be a steady one.”

- Markets remain undecided whether the central bank will deliver a further 25bp cut at the next policy meeting on September 19. Key wages and inflation data released ahead of the BoE meeting will be scrutinised to see if there is room for a further interest rate reduction. However, if a reduction is not produced in September, this opens the likelihood of a cut in November.

| Date | Country | Economic Release |

| 10-Sept-24 | UK | Jobless Claims Change |

| 10-Sept-24 | UK | Industrial Production MoM |

| 18-Sept-24 | UK | CPI YoY |

| 18-Sept-24 | UK | CPI MoM |

| 18-Sept-24 | UK | CPI Core YoY |

| 19-Sept-24 | UK | Bank of England Bank Rate |

| 20-Sept-24 | UK | S&P Global UK Manufacturing PMI |

| 23-Sept-24 | UK | GDP QoQ |

| 30-Sept-24 | UK | GDP YoY |

United States

- Speaking at the Federal Reserve Bank of Kansas City annual economic policy symposium in Jackson Hole, Wyoming last month, Federal Reserve Chairman Jerome Powell suggested that the central bank is likely to reduce interest rates at the September meeting. He told the audience, “The time has come for policy to adjust,” adding that the direction of travel is clear, but the details of the timing and pace of rate cuts will depend on several factors, including incoming data, evolving outlook and balance of risks.

- There have been mounting concerns that the Fed has been behind the curve, prompting some investors and analysts to push for a larger rate cut from the central bank, with the odds of a 50-basis point reduction increasing over the summer. The FOMC continues to monitor data releases based upon their dual mandate of maximum employment and price stability, so key inflation and labor market data are scrutinised as investors look for clues on the size and timing of adjustments to monetary policy.

- August labor market releases suggest that jobs growth has cooled, underlined by a softer than expected Non-farm Payroll release. The sector added 142,000 jobs in the month, lower than expected, with a net 86,000 downward revisions over the last two months. Whilst weaker, the overall labor market data was likely too soft to suggest significant confidence in the jobs market, however it was considered not weak enough to suggest an immediate 50bp reduction in September.

- Markets are also focusing on the other side of the Fed’s dual mandate, with the August CPI inflation report expected to come in unchanged from the previous month and consistent with the central bank’s 2% target.

| Date | Country | Economic Release |

| 11-Sept-24 | US | U. of Mich. Sentiment |

| 11-Sept-24 | US | PPI Final Demand MoM |

| 13-Sept-24 | US | CPI MoM |

| 17-Sept-24 | US | CPI YoY |

| 18-Sept-24 | US | Retail Sales Advance MoM |

| 23-Sept-24 | US | S&P Global US Manufacturing PMI |

| 24-Sept-24 | US | Durable Goods Orders |

| 26-Sept-24 | US | U. of Mich. Sentiment |

| 26-Sept-24 | US | Conf. Board Consumer Confidence |

| 27-Sept-24 | US | GDP Annualized OoO |

CURRENCY PAIRS ANALYSIS

EUR/USD

- After trading within a well-defined range over the summer, EURUSD broke higher in the final week of August as US treasury yields dropped as the market factored in rate cuts from the Fed following Chairman Powell’s comments.

- The pair rallied through resistance to test recent highs, trading as high as 1.12 before retracing.

- Interest rate differentials continue to drive currency markets and the outlook for EURUSD continues to be influenced by the size and timing of interest rates from both the Federal Reserve and ECB.

- Support: 1.1050 ahead of 1.0990

- Resistance: 1.1200 Aug high and 1.1275

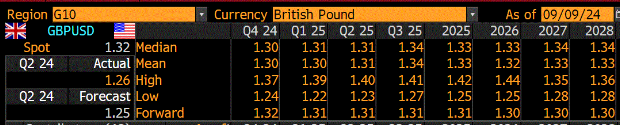

GBP/USD

- GBPUSD remains one of the best performing pairs in G10 throughout 2024. This was further boosted by a further rally above 1.30 after the Jackson Hole meeting last month. Cable is greatly influenced by the outlook for the US economy and as with EURUSD, the move higher in GBPUSD was short lived with the pair falling to consolidate a tad lower.

- The outlook for the pound remains further clouded by uncertainty around BoE rate cuts and the fiscal outlook of the new Labour government.

- Support: 3050, psychological at 1.30 ahead of 1.2850

- Resistance: 1.3200, 1.3260 and 1.3500

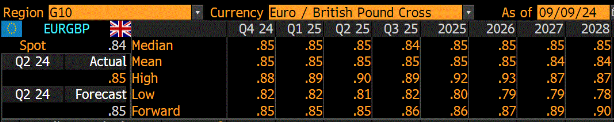

EUR/GBP

- EURGBP continues to trade within a 0.84 to 0.86 range, after breaking higher to test resistance last month before falling lower.

- Support: 0.8455 and 0.8400

- Resistance: 0.8500 and 0.8550

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.