Polling Insights: What Does the Future Hold for Euro, Dollar, and Pound?

Currency fluctuations can tell a story, one that reflects broader economic trends, geopolitical tensions, and the subtle shifts in central bank policies. As we move into October, recent events have brought these issues to the forefront. Inflation rates in the eurozone are teetering on the edge of the European Central Bank’s (ECB) 2% target, and US interest rate cuts remain a topic of intense speculation.

Navigating these unpredictable waters requires more than just keeping an eye on the headlines. At GPS Capital Markets, we believe that staying ahead means leveraging expert insights and real-time data, ensuring that businesses are not only prepared but protected. Whether it’s hedging against sudden currency shifts or making informed decisions based on the latest polling and economic forecasts, having the right strategy in place can make all the difference.

With the euro, dollar, and pound each facing their own sets of challenges—from inflation concerns to central bank interventions—it’s a pivotal time for market participants. Let’s dive in and explore how you can position your business to thrive in this volatile environment.

Euro-Area Inflation: A Defining Moment for ECB Rate Cuts?

Data released on October 2nd revealed a significant development: euro-area inflation slowed to 1.8%, dipping below the ECB’s 2% target for the first time in three years. The decline was driven by sharply lower energy prices and softer inflation across key eurozone economies like Germany, France, and Italy.

This drop in inflation has intensified expectations that the ECB will accelerate its rate-cutting path to support the struggling economy. Markets are now pricing in a 25-basis-point (bp) cut when the ECB meets on October 17, with another reduction likely in December, bringing the benchmark rate down to 3%.

The data has already impacted the euro, pushing EUR/USD lower after failing to maintain recent gains above 1.12. Currently, the pair is consolidating around 1.1060, with the psychological 1.10 level acting as a key area of support. A further breakdown is possible as markets digest this evolving economic landscape.

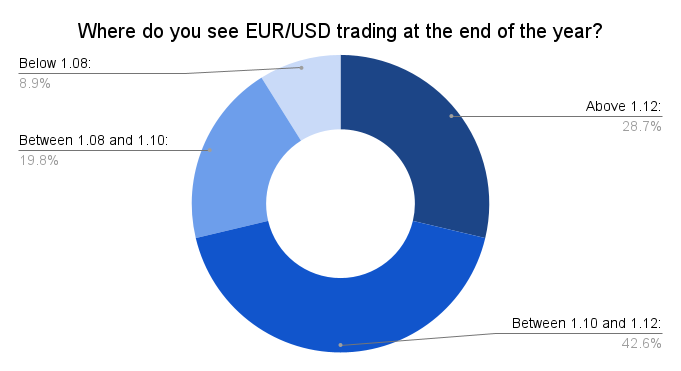

We asked our LinkedIn audience:

- Above 1.12: 29%

- Between 1.10 and 1.12: 43%

- Between 1.08 and 1.10: 20%

- Below 1.08: 9%

The ongoing euro weakness, driven by falling inflation and softer economic data, seems to validate the poll results that lean toward EUR/USD trading between 1.10 and 1.12 by year-end.

Impact of US Interest Rates and Powell’s Caution

Federal Reserve Chairman Jerome Powell’s recent remarks continue to influence the market’s outlook on the US dollar. In a speech delivered just days before, Powell reiterated that while the central bank is moving towards lower interest rates, the pace and size of those cuts remain uncertain.

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance,” Powell noted. However, he emphasized the Fed’s data dependency, saying, “But we are not on any preset course.” Markets are pricing in two smaller reductions of 25bp before year-end, although a 50bp cut at one of the final two policy meetings cannot be ruled out.

With US labor data coming into focus—starting with ADP Private Payrolls and culminating in Friday’s Non-farm Payrolls report—expectations for the size of future cuts could be clarified.

Fernando Minervini, Corporate Foreign Exchange Dealer at GPS, commented: “By the end of the year, the EUR/USD could range between 1.05 and 1.10, influenced by factors like central bank policies, inflation data, and geopolitical events. If the Federal Reserve stays hawkish or global risks rise, the dollar may strengthen. Conversely, if the European Central Bank tightens further or risk sentiment improves, the euro could gain momentum.”

Sterling Holds Ground Post-Brexit

The pound has remained relatively resilient, despite the lack of significant UK economic data in recent weeks. After peaking above 1.34 against the US dollar at the end of last month, sterling has consolidated its position. However, most of the movement is attributed more to dollar weakness than a considerable surge in sterling strength.

Tom Tragnett of Libertex Group provided more context in a LinkedIn comment, stating, “Perhaps you should remember: that for starters it rebounded back to a round 1.4375 at one point some two years after Brexit and then reached around 1.4250 in 2021, remembering it had traded below 1.40 ahead of the vote in 2016.”

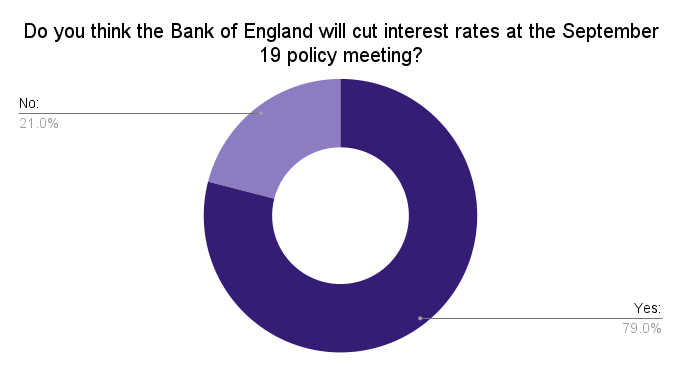

In light of ongoing market conditions, recent polls have revealed mixed expectations for GBP/USD, reflecting a cautious outlook as the UK continues to navigate its post-Brexit economy:

-

- Yes: 79%

- No: 21%

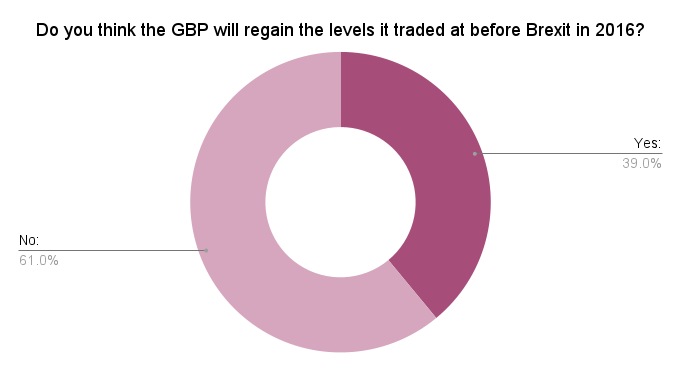

-

- Yes: 39%

- No: 61%

Following the September 19 meeting, the Bank of England decided to keep interest rates unchanged, a decision influenced by the mixed signals from the UK economy. This outcome was expected given the prevailing uncertainty surrounding inflation and growth, further complicating the path forward for the pound.

Sterling’s consolidation in the current range aligns with expectations for moderate gains, though much depends on how the UK economy and Brexit-related trade issues unfold over the coming months.

Sterling and Dollar Strength: A Tug of War

With minimal UK data driving market movement, sterling’s performance is largely tied to global factors, particularly the dollar’s value.

Simon Walker, Senior FX Analyst at GPS Capital Markets said, “The ongoing tug of war between sterling and dollar strength reflects broader macroeconomic factors, particularly central bank policies and inflation data.”

Simon Walker, Senior FX Analyst at GPS Capital Markets said, “The ongoing tug of war between sterling and dollar strength reflects broader macroeconomic factors, particularly central bank policies and inflation data.”

As noted above, the majority of the Brexit currency poll participants believe that the pound will not return to pre-Brexit levels. This aligns with current market realities, where the pound remains subdued due to economic uncertainty, inflation, and the slow recovery of the UK economy post-Brexit. While there is still potential for short-term rallies, long-term prospects for sterling are tempered by these ongoing challenges.

As the U.S. dollar faces pressure, the focus turns to upcoming U.S. labor market data. Recent employment figures have created confusion for market participants.

Concerns Over Private Sector Hiring

Inflation remains above the Federal Reserve’s target, and while the employment data appears positive on the surface, the reliance on government jobs raises questions about the health of the private sector. This, in turn, impacts how the Fed may approach interest rate cuts in the coming months.

Yesterday’s JOLTs report showed an increase in job openings, relieving some downside risk to the employment side of the Federal Reserve’s dual mandate. The ADP Private Payrolls report, due today, and Friday’s Non-farm Payroll release will provide further insights into the strength of the U.S. labor market.

Julien Dufour, FX & Treasury Risk Specialist at GPS, provided insights on the recent U.S. data: “The figures released in the US did not make much sense, especially the unemployment figures with lots of jobs being added despite less than expected. That was mostly due to an adjustment made for the previous month where they lowered the actual job creation figures to report it to the latest data. What also the figures don’t say is a lot of the jobs are government positions or linked to government contracts, which means the private sector isn’t hiring.”

Julien Dufour, FX & Treasury Risk Specialist at GPS, provided insights on the recent U.S. data: “The figures released in the US did not make much sense, especially the unemployment figures with lots of jobs being added despite less than expected. That was mostly due to an adjustment made for the previous month where they lowered the actual job creation figures to report it to the latest data. What also the figures don’t say is a lot of the jobs are government positions or linked to government contracts, which means the private sector isn’t hiring.”

As we look ahead to the Federal Reserve’s next policy moves, Dufour added, “The Fed therefore needed to show markets it was willing to stimulate demand and growth by supporting businesses and consumer spending. A rate cut of 50bps made more sense in that regard.”

Market Predictions: Expect the Unexpected

Tanner Bruner, Foreign Exchange Advisor, shared a perspective that encapsulates the challenges of predicting FX markets. “From my time working at GPS, one lesson stands out: predicting the market resembles predicting April weather in Utah. Just when you think you’ve discerned a trend, wham! an unexpected blizzard shows up on Easter, only for the sun to shine brightly the very next day.”

Tanner Bruner, Foreign Exchange Advisor, shared a perspective that encapsulates the challenges of predicting FX markets. “From my time working at GPS, one lesson stands out: predicting the market resembles predicting April weather in Utah. Just when you think you’ve discerned a trend, wham! an unexpected blizzard shows up on Easter, only for the sun to shine brightly the very next day.”

Bruner’s analogy speaks to the uncertainty that traders and analysts alike face. Whether discussing the EUR/USD pair or the broader implications of interest rate cuts from the Fed or ECB, the inherent unpredictability of global markets means that forecasts are often subject to rapid change.

Conclusion

The global FX market is in a state of flux, with euro-area inflation, US labor data, and geopolitical risks creating an uncertain environment for traders and businesses alike. As we move toward the end of 2024, much remains to be seen regarding how central banks will respond to these evolving conditions. Staying informed and hedging against volatility will be key to navigating the months ahead.

In the words of Bruner, “We’ll have to see how the two economies evolve and how the upcoming U.S. elections influence market dynamics.”

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.