How FXpert’s Automatic Payments Revolutionize FX Management

Imagine you’re the CFO of a growing global company with operations across Europe, Asia, and North America. Your team is spending hours each week managing cross-border payments, manually processing transactions, and reconciling payments between various subsidiaries. With every new currency fluctuation, you face added risks that threaten to erode profits. Despite the size and success of your business, your current payment system is inefficient, and you know it’s time to make a change.

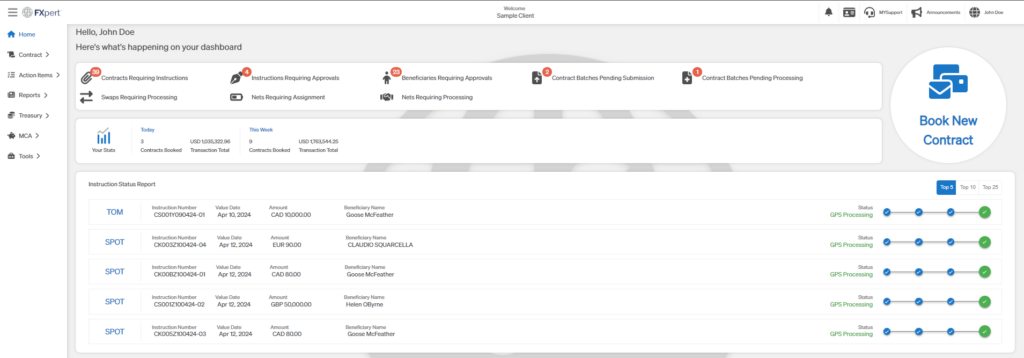

This is where FXpert comes in. With its automatic payment capabilities and ability to simplify cross-border payments, FXpert is built to streamline foreign exchange operations while offering 24/7 customer service to support your team at any hour. Whether your company is handling basic spot transactions or managing complex hedging strategies, FXpert has the tools to ensure your payment processes are as smooth as possible.

Optimizing Cross-Border Payments with FXpert

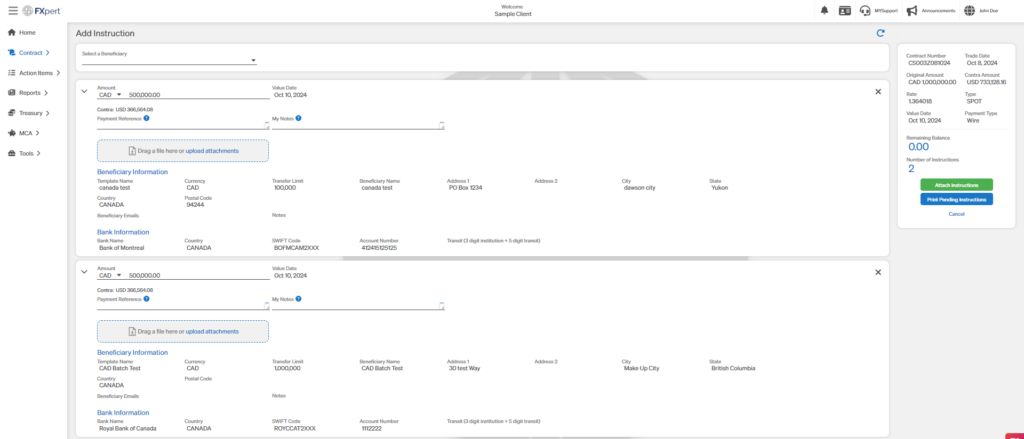

For companies that deal with cross-border payments regularly, inefficiencies in processing and reconciling payments can cost time and money. FXpert offers a solution by automating these processes, giving businesses an edge in efficiency and accuracy. The platform allows for automatic payments and handles various types of transactions, including SPOT, TOM, and CASH value, plus you can deliver to multiple beneficiaries using the split payment feature, all through an intuitive mobile or desktop interface.

What sets FXpert apart from other platforms is its ability to optimize payment flows using 25 years of trading experience and advanced data analytics. For businesses looking to maximize efficiency, this is a game-changer. By automating payments, FXpert minimizes human error and reduces the time your team spends on manual processes, allowing them to focus on more strategic tasks.

As a Controller in the Beauty Industry, USA, mentioned, “GPS offers favorable, money-saving FX rates and superior customer service. Their platform is intuitive, and trades are easy to execute, making cross-border transactions hassle-free.” This level of service is particularly valuable for businesses seeking to reduce the operational burdens of foreign exchange management.

Automation for Efficiency: The Power of Automatic Payments

One of the biggest advantages of FXpert is its ability to streamline automatic payments. Instead of handling payments manually, FXpert automates the process, reducing the likelihood of errors and ensuring that transactions are completed on time, every time. Whether you’re processing a one-off payment or managing a series of recurring transactions, FXpert’s automation tools make the process seamless.

For multinational companies, managing payments between subsidiaries can be especially challenging. FXpert simplifies this with intercompany netting, which consolidates multiple transactions into one, reducing the volume of payments and cutting down on FX fees. This feature is essential for businesses aiming to optimize internal financial operations across borders.

Moreover, GPS Capital Markets offers 24/7 customer support, ensuring that you have help whenever you need it. If you encounter issues or have questions about your transactions, GPS’s team is always available to provide assistance.

Streamlined Treasury Management Across Entities

Managing treasury functions across multiple global entities can be complex, but FXpert helps you streamline these processes by offering complete visibility and control over all your cross-border payments. Through the platform, you can track, manage, and forecast cash flows, exposures, and hedging strategies all from a single dashboard.

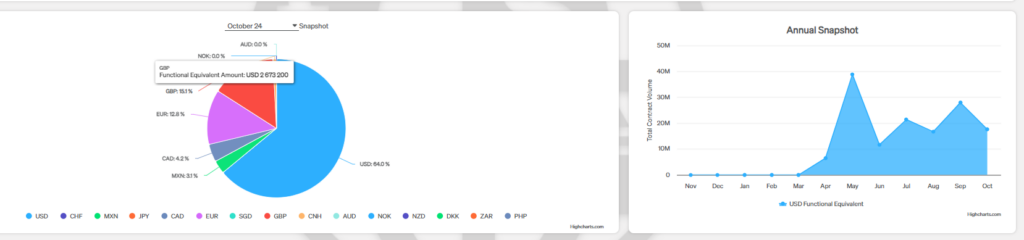

This ability to see and manage everything in one place allows treasury teams to make more informed decisions, reducing risk and improving overall performance. The platform’s data analytics and customizable dashboards provide real-time data, helping you stay on top of your FX exposure and currency fluctuations.

A Director of Finance at a UK Top 100 company commented, “I have worked with several of the GPS executives for over 12 years. In all they do, they provide a level of service superior to our lead bank.” This level of service, combined with FXpert’s robust treasury management tools, ensures that businesses can handle complex international transactions with ease.

Why FXpert is the Ideal Solution for Automatic Reporting

FXpert has the ability to connect to your ERP or internal reporting system to keep track of inflows and outflows of cash and dynamic balances. This is crucial for Treasury Analysts, AP/AR Specialists, or anyone on your financial team juggling complex auditing requirements. FXpert integrates to be an extension of your treasury management system.

“GPS provides your business with a dedicated expert who learns your core processes and equips you with the right tools to manage currency exposure effectively. From seamless payment execution to integration with your ERP system, FXpert streamlines your FX operations, maximizing efficiency and automation,” said Mat Marshall, Corporate Foreign Exchange Specialist at GPS.

Advanced FX Tools and Analytics

FXpert doesn’t just help you automate payments—it also provides advanced tools to improve your company’s foreign exchange strategy. Whether you’re managing balance sheet hedging or cash flow hedging, FXpert enables you to automate your hedging strategies while still offering complete control over your exposure.

The platform’s data analytics allow you to drill down into transaction details, providing you with the insights needed to optimize your FX strategy. You can track exposures, forecast future cash flows, and adjust your hedging approach based on real-time data.

In addition to these features, FXpert’s batch upload functionality simplifies the process of managing contracts and beneficiary payments. Instead of entering each contract or payment manually, treasury teams can upload them in bulk, saving valuable time and minimizing the chance of data entry errors.

Conclusion

If your business is still manually handling cross-border payments, it’s time to explore how FXpert can revolutionize your payment processes. With automatic payments and round-the-clock support, FXpert eliminates inefficiencies and gives you the tools to make smarter, faster, and more accurate foreign exchange decisions.

As global markets become more interconnected, staying ahead requires technology that can keep up. FXpert, with its advanced automation and robust data analytics, ensures that your company remains competitive in the ever-evolving world of foreign exchange payments.

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.