Market Reactions Following Trump’s Election: Global Shifts and Emerging Opportunities

Donald Trump’s victory piqued optimism across financial markets, with investors responding positively to the anticipated pro-business policies set to be introduced. Markets are already factoring in the potential for reduced regulations, tax incentives, and stronger US-centered trade policies, boosting confidence in sectors tied to domestic growth. The dollar has strengthened on this momentum, affecting currencies worldwide, including the euro, Australian dollar, and Mexican peso.

DXY Gains as Poll Respondents Cite Inflation as Most Important Factor in Election Outcome

The US dollar ticked up after Donald Trump’s 2024 presidential election victory, with Trump securing 312 electoral votes. Investors turned their attention to potential economic measures that could bolster domestic industry, potentially pushing inflation higher and prompting further interest rate adjustments. The DXY saw a significant uptick as these policy shifts began to reshape market expectations.

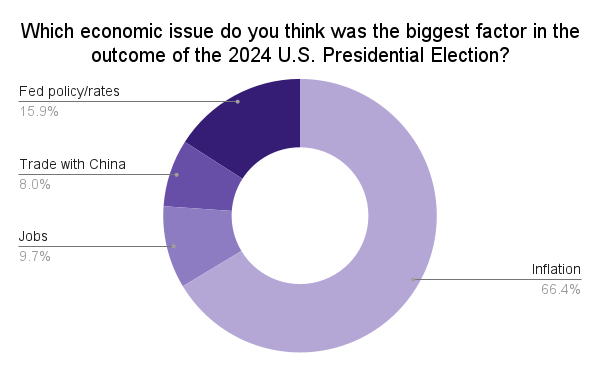

To learn more about the sentiment that led to Trump’s win, we conducted a poll asking participants, “Which economic issue do you think was the biggest factor in the outcome of the 2024 US Presidential Election?” The responses highlighted inflation as the predominant concern, with 66.4% of respondents citing it as the most significant factor. This result underscores the heightened focus on inflationary pressures and aligns with the broader market reactions, as Trump’s policies are expected to impact both domestic and global inflation trends.

- Inflation: 66.4%

- Jobs: 9.7%

- Trade with China: 8.0%

- Fed policy/rates: 15.9%

This focus on inflation suggests that voters are increasingly concerned about rising prices and the potential for continued rate hikes, which are also influencing investor sentiment in FX markets. As the Fed looks set to follow its recent interest rate cut with another move in December, markets will look to this week’s inflation data for clues on the pace of cuts in 2025. Wednesday, November 13th will see the release of the latest inflation report with headline and core CPI expected to remain at 0.2% and 0.3%. On a year-on-year basis, inflation looks set to rise to 2.6% (from previous 2.4%) with core coming in unchanged at 3.3%.

24-Hour Poll: Immediate Reactions in US Markets

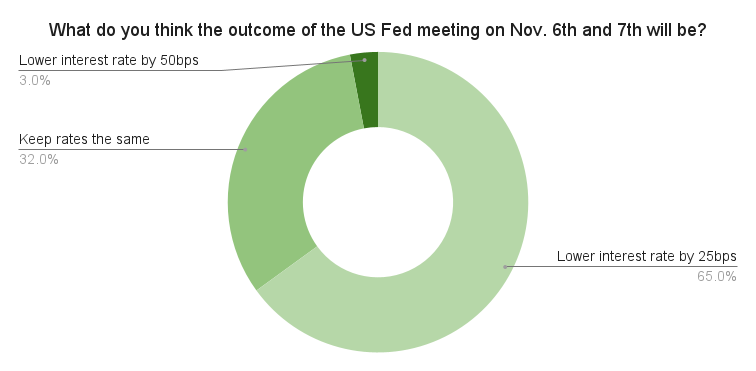

In a quick response poll conducted shortly after the election results, we gathered insights on expectations from the Federal Reserve’s November 6-7 meeting.

- Lower interest rate by 25bps: 65.0%

- Lower interest rate by 50bps: 3.0%

- Keep rates the same: 32.0%

- Increase rates: 0%

As seen in the poll, a majority (65.0%) predicted a mild rate cut, which was realized just after Trump was declared President-elect. The Federal Reserve implemented another 25bp interest rate cut, bringing the benchmark rate to 4.50-4.75%, aligning with the central bank’s gradual easing program to support growth. This, combined with the market’s “Trump trade” momentum, has led to a significant boost in the dollar index and US Treasury yields as inflationary expectations rise.

Impact on the Euro and European Markets

Matthew Hunter, FX Trader at GPS Capital Markets said: “Trump has announced a series of appointments to shape his administration, including Elon Musk, John Ratcliffe, and Pete Hegseth. Trump tariffs, Hegseth’s ‘America First’ stance, and other US-centric attitudes in the upcoming administration drive dollar strength. Market makers widely expect tariffs to cause a trade war between the EU and the US and negatively affect EU manufacturing in the short term.”

Adding to this in a post on LinkedIn, Charles-Henry Monchau, CFA, Chief Investment Officer and investing influencer, observed that the “Euro swap cash basis is negative for the first time since 1999. This highlights the increased cost of borrowing euros and converting them to dollars, showing that dollar demand is at an all-time high.” These dynamics reveal how US policies may have ripple effects on European borrowing costs and currency valuations.

Canadian Dollar Concerns: US Policies Dominate Outlook

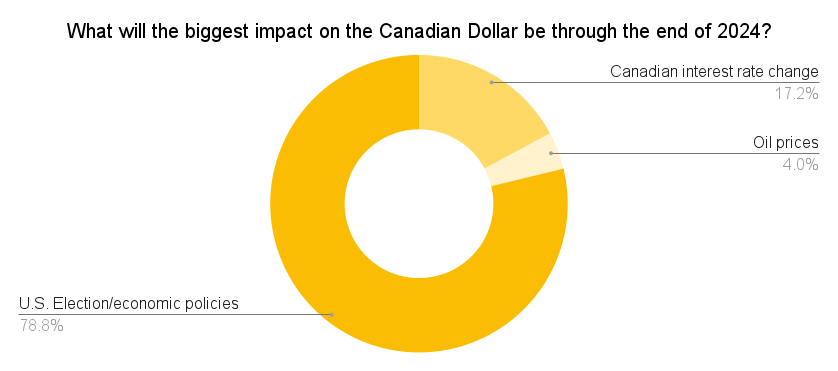

As a major trading partner, Canada is highly sensitive to US policy changes. A recent poll provided insights into factors expected to impact the Canadian dollar through the end of the year, revealing substantial concern about US economic policies:

- U.S. Election/economic policies: 78.8%

- Canadian interest rate change: 17.2%

- Oil prices: 4.0%

- Something else (in comments): 0%

An overwhelming 78.8% of respondents indicated that US economic policies would be the primary driver of CAD fluctuations, underscoring the close economic ties between the two nations.

Bitcoin and Cryptocurrency Surge on Election News

Following Donald Trump’s election victory, cryptocurrency markets surged, with Bitcoin reaching record highs. As of Monday, Bitcoin topped $87,000 for the first time, closing at $87,083, marking an impressive 28% increase over the past week, according to CoinDesk. This rally extends across the broader cryptocurrency market, as investors anticipate a potentially “crypto-friendly” stance from the incoming administration. Analysts suggest this approach could bring greater regulatory clarity and flexibility, encouraging further investment in digital assets.

Prediction markets reflect this optimism, with Kalshi reporting a surge in the probability of Bitcoin reaching $100,000 in 2024. The chance of Bitcoin hitting this milestone has climbed from 8% before the election to 38%, while the probability of Bitcoin surpassing $90,000 by year’s end now stands at 49%, according to data from The Kobeissi Letter. These odds signal strong investor confidence in cryptocurrency’s role in a shifting economic landscape as money flows rapidly into digital assets post-election.

Australian Dollar’s Response to US Election and Trade Tensions

Australia, closely tied to China’s economic performance, also faces new uncertainties. The Australian dollar has softened against the US dollar due to potential trade disruptions. Luke Coleman, FX Advisor at GPS Capital Markets, commented, “The Australian dollar is highly dependent on Trump’s potential tariffs on China. Australia’s resources, particularly iron ore, are closely tied to AUDUSD’s strength or weakness.” Coleman’s analysis emphasizes the potential vulnerability of the Australian dollar to fluctuations stemming from US-China trade policies, with implications for Australian exports and overall economic health.

Australia, closely tied to China’s economic performance, also faces new uncertainties. The Australian dollar has softened against the US dollar due to potential trade disruptions. Luke Coleman, FX Advisor at GPS Capital Markets, commented, “The Australian dollar is highly dependent on Trump’s potential tariffs on China. Australia’s resources, particularly iron ore, are closely tied to AUDUSD’s strength or weakness.” Coleman’s analysis emphasizes the potential vulnerability of the Australian dollar to fluctuations stemming from US-China trade policies, with implications for Australian exports and overall economic health.

The knock-on effects of Trump’s policies on the Australian stock market have also been mixed. Although some resource-heavy stocks benefited from initial optimism, investors are cautious as rising US tariffs may eventually dampen global demand for key Australian exports.

Impact on the Mexican Peso: Shifts in Trade and Border Policies

A central focus in the Trump campaign was the border crisis, with cartel and gang activity from Central America bringing record human trafficking and drugs across the border the past four years. Thomas Homan, the former acting director of Immigration and Customs Enforcement, warned Mexican cartels on Wednesday that former President Trump would wipe them “off the face of the earth.”

The Mexican peso initially reacted to Trump’s win with caution, but analysts suggest that Trump’s focus on fair trade agreements could pave the way for enhanced economic ties between the US and Mexico. This opens up prospects for increased investment in Mexico as both countries may revisit and strengthen trade frameworks to promote cross-border economic growth, as Trump’s main focus will be solving the border crisis.

Chinese Yuan Faces Headwinds Amid Tariff Concerns

In China, officials responded cautiously to the US election outcome. The Chinese yuan depreciated on the back of renewed fears that increased tariffs could be re-imposed, impacting China’s exports and overall economic stability. Trump’s proposed tariffs on Chinese imports, which could be as high as 60%, present substantial challenges for China’s economic strategy.

Recent statements from the Chinese Foreign Ministry emphasize a cooperative stance on trade relations but warn of potential destabilization if tariffs are enacted. In response, China may increase its stimulus efforts to counteract economic headwinds from a potential trade war.

Conclusion: Navigating FX Markets Post-Election

The 2024 US election has already had significant effects on currency markets, particularly for the DXY, Mexican peso, Canadian dollar, Chinese yuan, and Australian dollar. As Trump’s policy direction becomes clearer, FX markets are likely to experience continued volatility. For investors and FX market participants, monitoring developments in US trade, interest rates, and economic policies will be critical in informing strategies moving forward.

For navigating these complexities, GPS Capital Markets offers actionable FX trading advice tailored to businesses’ needs. Their FX trading platform, FXpert, simplifies processes such as international payments, intercompany netting, and balance sheet hedging. By providing a comprehensive suite of tools, GPS Capital Markets helps businesses effectively manage currency risk and stay ahead in a rapidly changing global environment.

Download the GPS CFO Checklist for finance tips here.