Critical Factors Affecting Operating Costs in the Resource Sector

![]()

Operating costs in the resource sector are expected to ease in 2023 due to volume improvements, yet inflationary pressures remain with labour costs putting upward pressure on operating expenditure (OPEX).

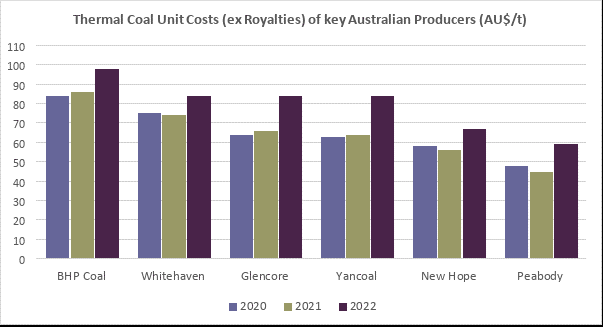

At the recent Asia Pacific Carbon Conference (APCC) in Newcastle, Australia – coal producers openly discussed the increasing cost of operating mines in Australia. The average increase in operating costs for Australian coal producers between 2021 and 2022 was 18%. Key factors contributing to cost increases are inflation (labour, fuel, and consumables), production constraints (producing less coal to sell with same overheads) and foreign exchange (FX) rates.

“We’re already seeing that weather related production constraints lead to an increase in operating costs, and many producers are also struggling with soaring labour costs.” says Dr. Matthew Anderson, Director of Research and Consulting at Commodity Insights.

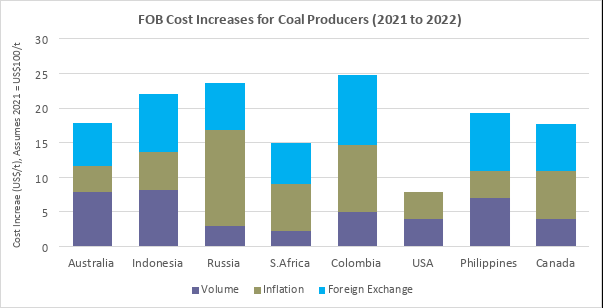

According to Commodity Insights’ analysis of global operating costs across major coal producing regions, inflationary costs increased between 4% and 14% in 2022, while volume pressures (including adverse weather impacts from La Nina) increased between 3% and 8%. The impact of FX experienced a 6-8% increase in 2022.

Yohan Huria, Senior Dealer for GPS Capital Markets suggests that while inflation and supply constraints are major factors, FX impacts are having an equal impact on marketing teams, with the need to hedge operating costs (in the local currency) against the sales price (in US Dollars). “The cost impacts of the La Nina weather pattern to producers is roughly the same as the FX cost impacts of the fluctuating AUD/USD cross during 2022. The amazing thing with this fact is the FX cost will be largely undetected by producers that are picking their FX budgeted rate on an ad hoc basis at time of sale. This is a significant sum that most coal producers would rather have in their pocket than someone else’s, particularly in current times where a QLD producer pays the highest government royalty rate globally.”

CONSTRAINTS TO GROWING PRODUCTION

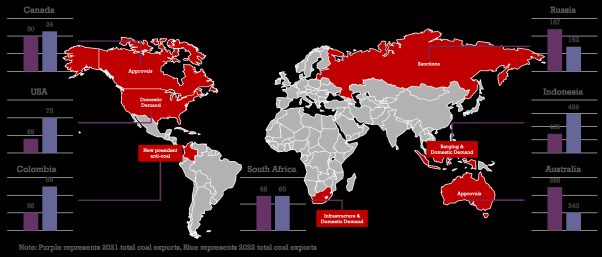

Suppliers face considerable constraints to increasing production. The list includes sanctions on Russian coal, approvals (Australia and Canada), anti-coal sentiment (Colombia), and domestic demand (Indonesia, South Africa, and United States).

In the developing economies of China and India, demand for coal remains strong and coal-fired power generation is still being built. Notwithstanding the supply constraints noted above, this will continue a trend of trade flows altering to the ever-changing demand and supply dynamics.

HOW TO MITIGATE RISING COST

To help manage inflation and labour costs, as well as increase production, it was suggested at APCC that technology and automation present a huge opportunity for operators to do this. In Commodity Insights’ view, the capital expenditure for technology and automation is unlikely as the coal sector (particularly in western economies) is already struggling to secure investment and obtain approvals for new mining projects.

For foreign exchange risk mitigation, operators typically utilise a panel of FX partners including their key banking relationship, and using spot, forward exchange contracts, options, and settlement limits – will execute spot trading and cash-flow hedging to manage costs in repatriating US dollars revenue back to their local currency. The goal for producers with their FX cash-flow hedging is to preserve the margins that coal marketers negotiate with buyers.

YOUR EXPOSURE MANAGEMENT PARTNERS

As a dedicated FX risk management firm, GPS Capital Markets can assist producers in executing their FX treasury requirements. In addition, as a free value-add, GPS provides a best-in-class Treasury Management System (TMS) that enables operators to better aggregate and proactively manage their FX risks. This includes a dedicated Quantitative Risk Analysis team that pulls data in from any enterprise and financial system, to work with marketers and treasury teams to help them identify and proactively manage FX risk.

Through the partnership Commodity Insights has built with GPS Capital Markets, coal producers have access to insights and tools to move forward in managing their two biggest exposures – coal/asset pricing and FX rates.