Decoupling: Currency and Financial Instrument Correlation in FX Markets, Pt. 2

In GPS’ last article, we examined the role of correlation analysis in understanding currency movements, from Bitcoin’s evolving relationships to traditional currency pairings like EUR/USD and GBP/USD, among others. This discussion provided insights into how traders align strategies with interconnected markets. We’re now going to turn our focus to decoupling—when historically correlated currencies or financial instruments begin to diverge—a significant trend in 2024.

What Is Currency Decoupling?

Currency decoupling refers to the breakdown of long-standing correlations between financial instruments or currency pairs. These shifts often stem from geopolitical events, divergent economic policies, or technological advancements. Decoupling introduces both risks and opportunities, challenging traders to adapt quickly while offering new avenues for strategic hedging.

For instance, the Mexican peso (MXN) and Chinese yuan (CNH), once moderately correlated due to shared exposure to global trade dynamics, have shown signs of divergence. Political shifts in North America and China’s post-pandemic recovery policies have caused these currencies to decouple, leading to businesses reliant on trade between these regions to rethink hedging strategies.

Decoupling Trends in 2024

Gold and the S&P 500: A Historic Anomaly

Gold and the S&P 500 typically move inversely, as gold serves as a safe haven during equity market downturns, but 2024 has defied expectations. Both gold and the S&P 500 have surged simultaneously—a rare phenomenon last observed in the early 1980s.

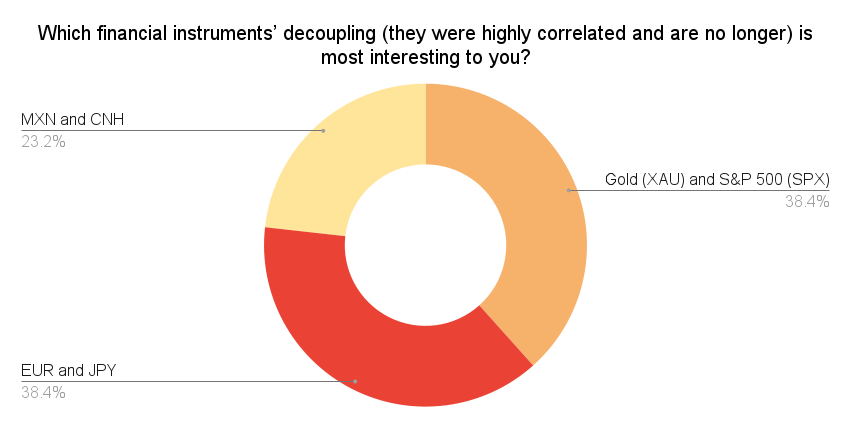

By October 2024, gold climbed 25% year-to-date, while the S&P 500 saw a comparable rise, driven by a mix of investor optimism and inflationary pressures. This decoupling complicates traditional diversification strategies, leaving traders to seek new hedging instruments. We asked:

- Gold (XAU) and S&P 500 (SPX): 38%

- EUR and JPY: 38%

- MXN and CNH: 23%

FXpert’s robust analytics have proven invaluable in helping clients understand and respond to these anomalies, offering real-time insights into how macroeconomic forces impact traditional correlations.

EUR and JPY: Diverging Monetary Policies

In 2024, the euro (EUR) and Japanese yen (JPY), once correlated due to shared safe-haven status, have decoupled significantly. The European Central Bank (ECB) maintained its tightening stance to combat inflation, while the Bank of Japan (BoJ) kept its ultra-loose monetary policy intact.

This decoupling underscores how geopolitical pressures, such as the Eurozone’s energy crisis and Japan’s reliance on imported commodities, can fracture historical correlations.

Decoupling in Cryptocurrency Markets

Cryptocurrencies have introduced unprecedented dynamics into global financial markets. In 2024, Bitcoin (XBTUSD) continued its trend of minimal correlation with traditional currencies, with its strongest positive correlation observed against the AUD/USD.

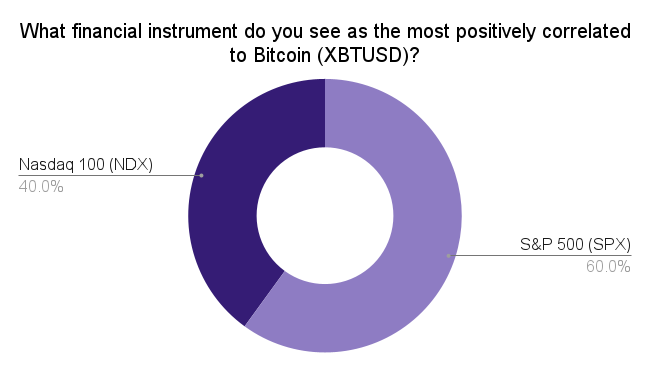

Interestingly, Bitcoin has shown a closer relationship to equity indices like the S&P 500 and the Nasdaq 100. As digital asset adoption accelerates in regions like Australia, this evolving correlation challenges traditional views of Bitcoin as an uncorrelated asset. We asked our LinkedIn audience:

- S&P 500 (SPX): 60%

- Nasdaq 100 (NDX): 40%

- GBP/USD: 0%

- AUD/USD: 0%

Strategies for Navigating Decoupling

As decoupling becomes more common, businesses must adapt their FX strategies to remain competitive. Here are some practical approaches:

- Enhanced Correlation Analysis: Regularly review correlation coefficients to identify shifts early. FXpert offers customizable dashboards to monitor these changes in real time.

- Dynamic Hedging Strategies: Diversify hedging instruments to mitigate risks associated with decoupling trends.

- Scenario Planning: Leverage FXpert’s scenario analysis tools to model potential outcomes and adjust portfolios accordingly.

The Importance of Technology in Managing Decoupling

Advanced platforms like FXpert play a crucial role in helping businesses manage the complexities of decoupling. From real-time market insights to automated hedging tools, FXpert enables clients to anticipate and respond to evolving market dynamics effectively.

One of FXpert’s standout features is its ability to integrate cross-border payment solutions with hedging strategies. This integration ensures that businesses not only manage currency risk but also optimize their payment workflows—essential for navigating the unpredictable landscapes of decoupled markets.

Looking Ahead

As 2025 approaches, the impacts of decoupling are likely to intensify, influenced by geopolitical uncertainty, inflationary pressures, and shifting monetary policies. FXpert continues to provide clients with the tools needed to navigate these challenges, from actionable trading advice to streamlined FX payments.