FX Balance Sheet Hedging: Providing Value by Protecting Value

Providing Value

This May marked eight years since I started working at GPS as an FX Advisor. I have become increasingly grateful I made the decision to go into FX, as the field has become more important for many businesses bracing against market volatility over the last few years.

Shortly after I started my position here, I was lucky enough to stumble upon a lecture given by Jim Donovan (a professor at UVA Law school) that has been fundamental to me finding success and fulfillment within my career.

Donovan draws from his career in Investment Banking to teach his law and banking students how to grow business through relationships and networking at their future firms (how to be “rainmakers”). What is surprising is that not only are the tips he gives extremely effective at growing business, but they promote integrity and doing business “the right way.” The lecture is helpful for anyone that is in a consultative role, regardless of the industry and I think the principles can be applied to any relationship in or outside of work. It’s all about creating value for someone as an advisor; a hat that we all put on at one point or another.

In the lecture, Donovan teaches how to really add value to your clients. Things like being an all-around advisor, making recommendations that are in the client’s best interest, especially if they are not in your interest, and responding as quickly as possible to clients so that they know they can depend on you. He also discusses providing real, strategic advice from your area of expertise to the client so that they can have confidence in an area that may be unfamiliar or new to them.

At GPS, I’ve learned how to provide this kind of advice so that clients can understand their FX exposure and develop an effective plan for protecting themselves from FX risk. This expertise is enhanced by FXpert, a treasury platform we’ve developed to give visibility into exposures and make the hedging process more efficient.

Protecting Value (Balance Sheet Hedging)

FX balance sheet hedging is an area where we at GPS have a unique competitive advantage due to our structure and FX management tools, allowing us to significantly reduce the time and cost spent on a hedging program while also increasing efficiency.

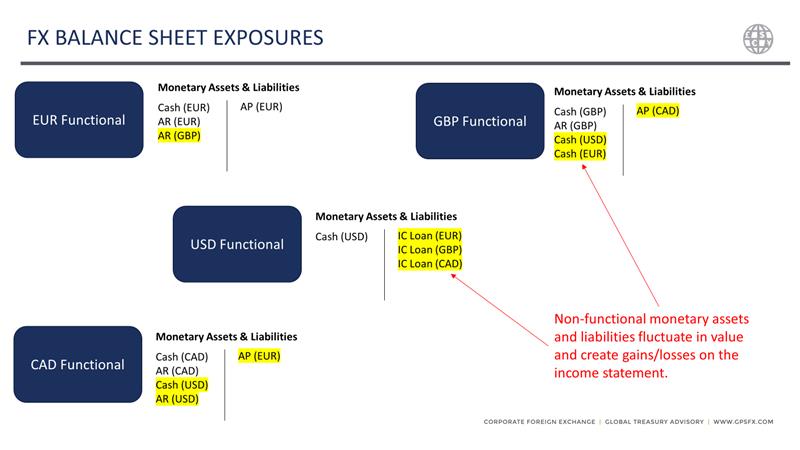

Let’s start by explaining what balance sheet exposures are and why companies hedge them. Basically, the goal is to protect the value of the company from current assets and liabilities that are exposed to FX risk. (Think FX gains/losses on a financial statement.)

Sometimes companies hold cash, have short-term loans, or accumulate payables/receivables in currencies other than their main operating currency. Their main operating currency is called their functional currency – let’s use USD as an example. If a company in the US (USD functional) has EUR cash on its books, that cash will get revalued at the end of every month based on the change in the EUR/USD exchange rate. This creates a gain or a loss that goes on the income statement and affects net income.

Or alternatively,

The reason why accounting rules put these gains/losses above the net income line on the income statement, is because they are current monetary assets/liabilities; this includes cash, AR, AP, and short-term loans (less than a year or sometimes two years). It makes sense because these short-term accounts change frequently so they are having real effects on profitability when exchange rates move, and they must make an actual conversion at that rate.

Companies protect this risk by using an offsetting forward contract to match up their own gain/loss with the gain/loss on the monetary asset/liability. See two examples below:

This is simple if a company has one exposure to one currency. But this process can become extremely complicated for a company with multiple subsidiaries in different countries with many transactions. All these entities will have different exposures, and it usually does not make sense for them to hedge each individual item—that’s why GPS created a tool that makes it easy to net out these exposures across entities and hedge from a corporate level. That way, companies can take advantage of natural hedging, automate the process to reduce workload on the treasury team, and increase the effectiveness of their hedging program. Here’s how this process is done:

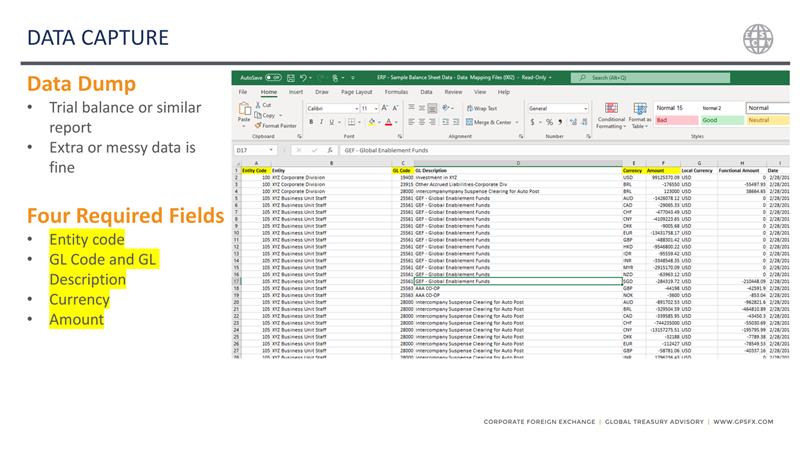

Step 1: Data Capture

We start by taking a report from the client’s ERP to feed data into the system from all of their subsidiaries.

This data can be manually sent or automated with an SFTP or API connection. What is powerful about the automation of this step is that companies can increase their frequency of uploading data into the system. That way they can adjust to significant changes throughout the month so that they can better match up with the actual gains and losses. Companies without a BSH tool who have a process that takes longer to look at their numbers will try to compensate for changes throughout the month by forecasting what their numbers will be and hedging their forecasts, but there will always be some noise since you are not hedging your actual exposure when it is recorded. My clients find it can be powerful to have the ability to look at your actuals more frequently so that you are hedging more precisely.

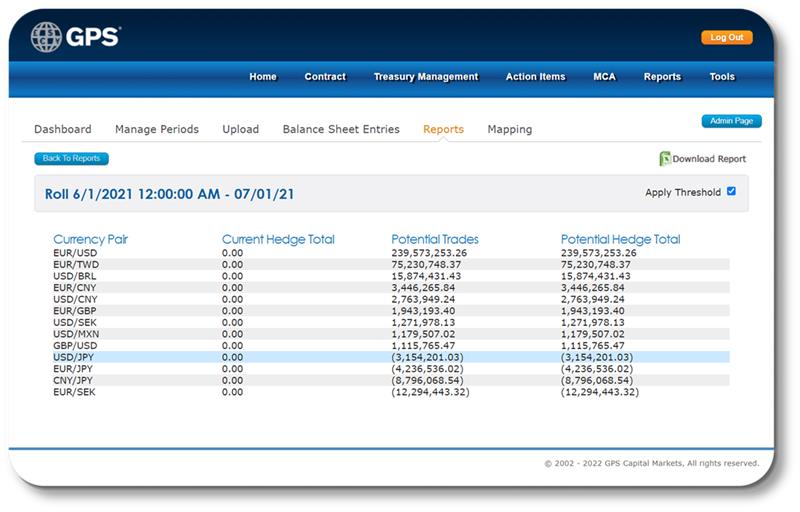

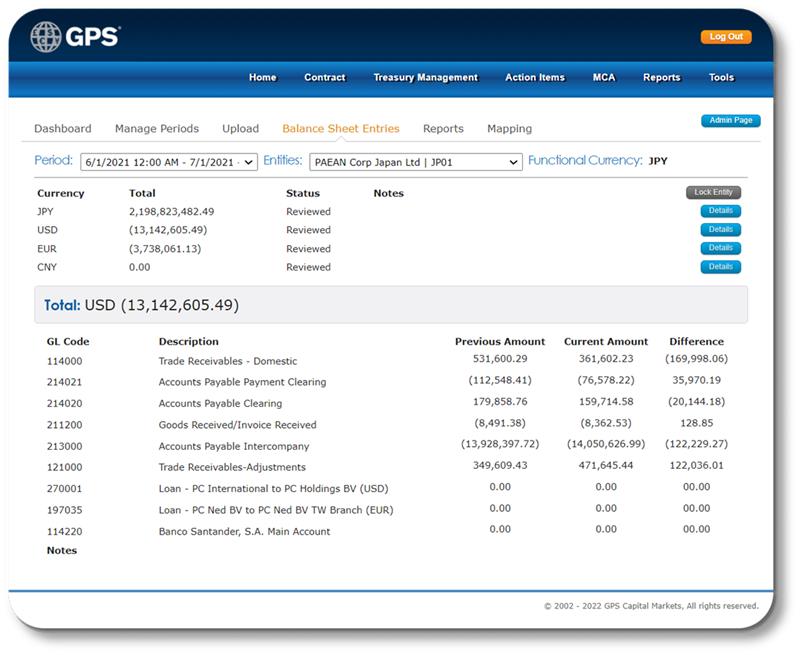

Step 2: View Exposures

Once the data is in the system, companies can view all of their net exposures from a corporate level.

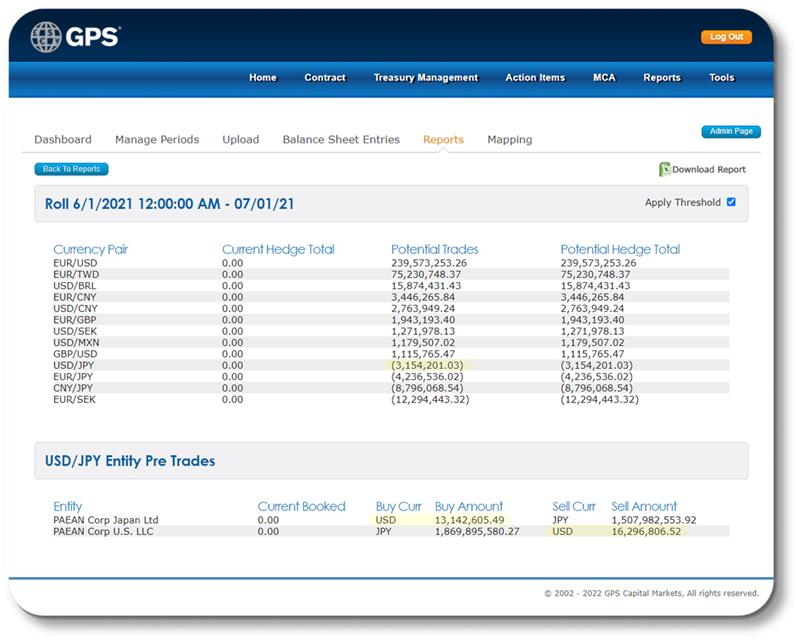

Another cool feature is that companies can then drill down to see exactly which entities are contributing to this net exposure. You can see here that the two entities are creating a natural hedge against each other reducing the overall exposure to be hedged. Then you can drill down into the entity itself and see what is creating this exposure. This not only gives you insight into your FX risk but may give helpful information about your global corporate structure.

Step 3: Analyze the Data

Our team takes time with every update to look at this information so that we can ensure the data in the system is accurate. If something looks off, we may comb through the ERP report to make sure that the data is good. Frequently, we find a problem to be fixed that would likely have been missed with a manual process. Our clients have often expressed the value that comes from having a second pair of eyes to comb through the data and make sure real exposures are being hedged as accurately as possible.

GPS Strategic Advantages

A strategic advantage that GPS has is that once these numbers are approved and submitted, we bid these hedges amongst our counterparties or counterparties specified by the client. This means the client can benefit from pricing power while reducing the workload of setting up multiple ISDAs, tracking down multiple MTMs, and paying/receiving settlements with multiple counterparties.

There are several other strategic advantages GPS has, but I’ll highlight one more. Because we are hedging from a corporate level with all the ERP data, we can hedge the net exposure while providing hedge contracts at a subsidiary level as if each subsidiary were individually hedged. This usually is not necessary but there are some situations/countries where a subsidiary can benefit from reporting their own hedge for tax or reporting purposes.

Conclusion

I hope you found this article and the illustrations of GPS’ processes helpful. Every company’s situation is unique and will require a slightly different solution, so please feel welcome to reach out and connect. The most helpful analysis and advice will be unique to your company and tailored to your situation.

For an analysis of your exposures and currencies mentioned in this client case study, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.