FX Market Brief: November 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- The ECB delivered another 25bp reduction at the October 17 policy meeting, taking the benchmark rate to 3.25% from 3.5%. The move was fully priced in and was the first time that the ECB had cut in consecutive policy meetings since 2011.

- Governing Council members and ECB President Christine Lagarde continue with non-committal language on the future path of interest rates, pledging “data dependant” actions on a “meeting by meeting” basis.

- Inflation in the euro-area remains close to target and there continue to be concerns over the outlook for the euro area, so further interest rate cuts in 2025 remain likely, with a 25bp cut expected at the December policy meeting.

- The victory by Donald Trump in the US elections prompted the single currency to sell off as markets expect the euro area to be particularly impacted by tariffs, with expectations of a decrease in GDP by up to 0.9%.

| Date | Country | Economic Release/Event |

| 12-Nov-24 | Euro-Aggregate | German ZEW Survey |

| 13-Nov-24 | Euro-Aggregate | CPI MoM |

| 13-Nov-24 | Euro-Aggregate | CPI Core YoY |

| 14-Nov-24 | Euro-Aggregate | GDP for Q3 |

| 22-Nov-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 22-Nov-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 22-Nov-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

United Kingdom

- After pausing in September, The Bank of England delivered a 25bp interest rate cut at the November 7 policy meeting, taking the benchmark rate to 4.75%. The cut was expected and was voted 8-1 by MPC policymakers and came just a few days after the first Labour Party Budget in 14 years.

- The Budget detailed tax increases, with UK companies baring the brunt of much of the fiscal tightening, prompting fears of increased unemployment. Increased government borrowing made further headlines, however the act of spending the proceeds to fund greater public sector investments is expected to stoke both growth and inflation in the years to come.

- With concerns that the budget will boost inflation, markets have repriced the pace of interest rates from the BoE with yields rising, partly on the back of the budget and partly following Donald Trump’s victory.

- The MPC has acknowledged that the economic outlook and the path for interest rates were highly uncertain, suggesting that interest rates would be lowered “gradually.” With one more policy meeting in 2024 (December 19) markets remain uncertain on whether the MPC will provide an early Christmas gift to UK households in the form of a final interest rate cut in 2024.

| Date | Country | Economic Release |

| 12-Nov-24 | UK | Jobless Claims Change |

| 20-Nov-24 | UK | CPI YoY |

| 20-Nov-24 | UK | CPI MoM |

| 20-Nov-24 | UK | CPI Core YoY |

| 22-Nov-24 | UK | Retail Sales |

| 22-Nov-24 | UK | S&P Global UK Manufacturing PMI |

United States

- Politics took centre stage in recent weeks, with Republican candidate Donald Trump winning the US election, securing a majority in the Senate and edging closer to overall control of US Congress.

- Just after Trump was declared President-elect, the Federal Reserve delivered a further 25bp interest rate cut, dropping the benchmark rate to a range of 4.50-4.75%. The move follows a 50bp reduction at the September meeting and was widely expected as the central bank continues with its gradual easing program. A further 25bp cut is expected at the final FOMC meeting on the year in December as officials continue to tweak policy to retain their dual mandate.

- Whilst the Trump-effect is unlikely to have much of an impact on Fed policy in the months to come, his impact on markets can already be felt two months ahead of being inaugurated as 47th Ahead of the election, the so called “Trump trade” helped to boost the US dollar as markets expected tariffs, which would negatively impact both China and the EU. Treasury yields have gained as inflationary fears increase with the dollar index gaining and EURUSD dropping to its lowest level in six months.

| Date | Country | Economic Release | |

| 13-Nov-24 | US | CPI MoM | |

| 13-Nov-24 | US | CPI YoY | |

| 15-Nov-24 | US | Empire Manufacturing Survey | |

| 15-Nov-24 | US | Retail Sales Advance MoM | |

| 22-Nov-24 | US | S&P Global Manufacturing PMI | |

| 26-Nov-24 | US | FOMC Meeting Minutes | |

| 27-Nov-24 | US | Core PCE |

CURRENCY PAIRS ANALYSIS

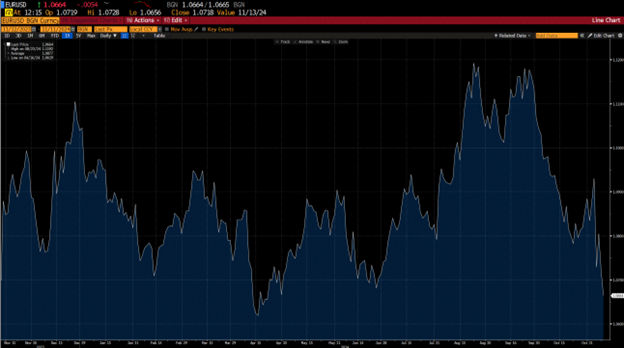

EUR/USD

- The single currency has been in a steady decline after failing to significantly breach 1.12 over the summer. With the outlook for the euro area continuing to appear soft and further interest rate cuts from the ECB in the pipeline, further declines are expected.

- A test of the 2024 low of 1.0620 is likely, opening the way to the psychological 1.05 area.

- Support: 1.0660 ahead of 1.05

- Resistance: 1.0820 and 1.0920

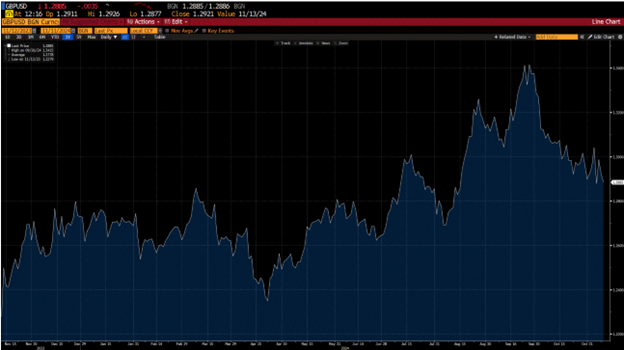

GBP/USD

- GBPUSD held up well during the summer after receiving a post UK election boost. The pair has however failed to hold on to gains above 1.30 and has slipped as the US dollar gained following Trump’s election victory.

- The UK budget has led to further concerns over the outlook for the UK economy as tax increases and inflationary concerns weigh on the currency.

- Support: 1.2840 ahead of 1.2800

- Resistance: 1.3010 and 1.3200

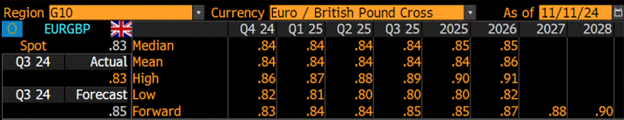

EUR/GBP

- After range trading for much of the year, EURGBP broke lower to hover above key support at 0.83 – a level which has held since the Brexit vote in 2016.

- With concerns over the impact of tariffs on the EU economy, the single currency has finally broken key support with the 2020 low of 0.8282 looming.

- Support: 0.8280 and 0.8200

- Resistance: 0.8380 and 0.8420

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.