FX Market Brief: October 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- The ECB lowered interest rates at its 12 September policy meeting in response to inflation falling towards the central bank’s 2% target and fears over the outlook for the economy. The key interest rate was cut by 25bp to 3.5% and follows the same sized reduction in June and a pause in July.

- ECB President Christine Lagarde and officials on the Governing Council reiterated that they can’t commit to a specific path for interest rates as the outlook remains “data dependent.”

- Inflation in the euro-area slowed below the ECB’s 2% target for the first time in three years. Consumer Prices rose 1.8% from a year ago, down from the previous recording of 2.2% as energy prices dropped sharply. Markets predict that the ECB will need to loosen monetary policy at an even faster pace than previously anticipated to boost a struggling economy amid unexpectedly rapid disinflation.

- The central bank next meets on 17 October and a further 25bp cut to follow September’s reduction is currently priced in. Markets are currently expecting a further reduction of the same magnitude at the December meeting, taking the benchmark rate down to 3%.

| Date | Country | Economic Release/Event |

| 15-Oct-24 | Euro-Aggregate | German ZEW Survey |

| 17-Oct-24 | Euro-Aggregate | CPI MoM |

| 17-Oct-24 | Euro-Aggregate | CPI Core YoY |

| 24-Oct-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 24-Oct-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 24-Oct-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

| 30-Oct-24 | Euro-Aggregate | GDP for Q3 |

United Kingdom

- The Bank of England kept interest rates on hold at its September policy meeting and warned that it will not be rushed in to easing policy as rate setters continue to look for signs that inflationary pressures have eased. The pause was expected, with MPC members voted by 8-1 to keep rates unchanged at 5%.

- UK inflation rose 2.2% in August, unchanged from July and in line with market expectations. The latest report was slightly above the BoE’s 2% target however services inflation rose to 5.6%, up from 5.2%.

- The central bank next meets on 7 November and the market remains divided on whether the MPC will cut or pause. At least one more cut of 25bp is expected in 2024 and this may either come in the November meeting or the final meeting of the year in December.

- Governor Andrew Bailey turned decidedly dovish this month. In an interview with the Guardian newspaper, he said that he sees a chance of more aggressive cuts if news on inflation continues to be supportive. However, his MPC colleague, Chief Economist Huw Pill who dissented at the August meeting urged caution on cutting interest rates “too far or too fast.”

| Date | Country | Economic Release |

| 15-Oct-24 | UK | Jobless Claims Change |

| 16-Oct-24 | UK | CPI YoY |

| 16-Oct-24 | UK | CPI MoM |

| 16-Oct-24 | UK | CPI Core YoY |

| 18-Oct-24 | UK | Retail Sales |

| 24-Oct-24 | UK | S&P Global UK Manufacturing PMI |

United States

- The Federal Reserve slashed interest rates by 50bp its September policy meeting. In the days ahead of the announcement the market was split on the size of the reduction, and the 50bp move is seen as an attempt to ensure that the US economy achieves a soft landing. Chairman Jerome Powell justified the larger reduction, saying, “The labor market is actually in solid condition, and our intention with our policy move today is to keep it there.” He added, “To me, the logic of this – both from an economic standpoint and also from a risk-management standpoint – was clear.”

- The central bank updated its projections indicating 100bp of cuts in 2024 and 2025, consistent with a downshift to reductions of 25bp increments going forward. The bumper 50bp cut is not expected to be repeated with markets now expecting further cuts of 25bp in November and December as the US economy looks to achieve a soft landing.

- The central bank remains focused on its dual mandate of employment and inflation, with price pressures moving towards the Fed’s target rate. The September employment report showed a solid Non-farm Payroll print of 254k, which was higher than the market was expecting. The previous month was revised higher, and the unemployment rate fell suggesting that the central bank is unlikely to be required to cut by a further 50bp at the next meeting, and can likely choose to be more conservative and deliver consistent cuts of 25bp towards the end of 2024 and into 2025.

| Date | Country | Economic Release | |

| 10-Oct-24 | US | CPI MoM | |

| 10-Oct-24 | US | CPI YoY | |

| 11-Oct-24 | US | U. of Michigan Sentiment | |

| 17-Oct-24 | US | Retail Sales Advance MoM | |

| 24-Oct-24 | US | S&P Global Manufacturing PMI | |

| 30-Oct-24 | US | ADP Employee Change | |

| 31-Oct-24 | US | PCE Personal Spending |

CURRENCY PAIRS ANALYSIS

EUR/USD

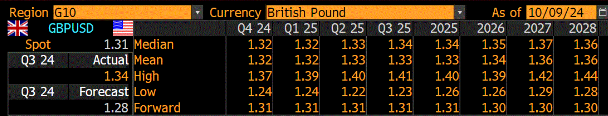

GBP/USD

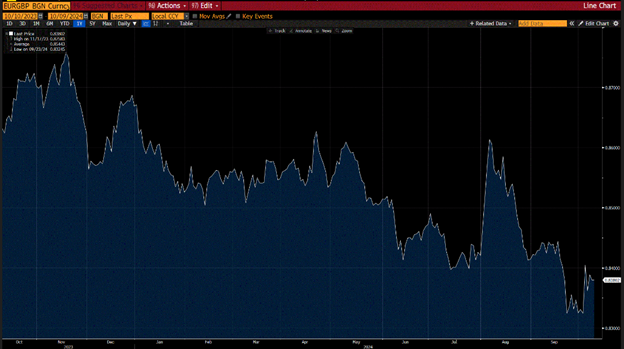

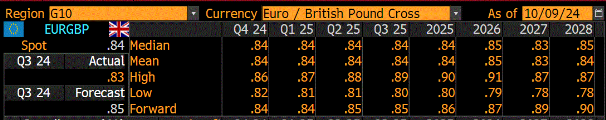

EUR/GBP

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.