FX Markets Update: December 2023

ANALYSIS BY REGION

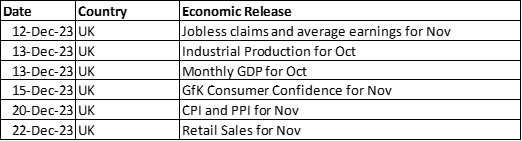

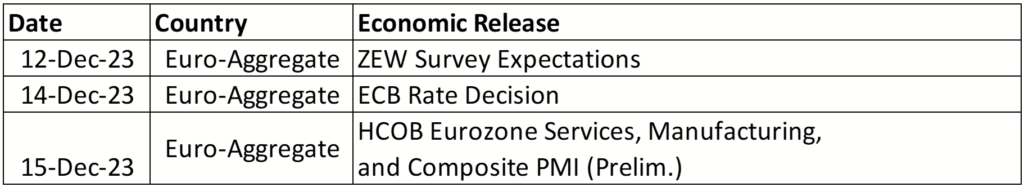

Euro-Area: Is a recession imminent or are we in one?

- The last time the European Central Bank met was on the 26th of October when all three key policy rates were left unchanged. For this month’s meeting, markets are expecting the same and truly believe the ECB is done hiking interest rates with traders pricing in a 75% chance of a first rate cut in March 2024, and 135 basis points of cuts for the next 12 months. This FX Markets Update finds the economic outlook for the euro area remains weak and there are clearer signs of a recession in the region.

- A combination of a softer CPI print, contracted activity gauges, and a tight labour market, indicates that the economy no longer can support further tightening leading the central bank to remain on hold, but cautious.

- Euro-area headline inflation dropped to 2.4% in November from 2.9% in October, but it is expected to tick again higher in December.

- Recent data now opens the door for rate cuts in 2024 and invites key hawkish members to adjust their tone to a more dovish one, but this is subject to how well the economy will perform when inflation starts to fall and space for rate cuts are available.

- The Federal Reserve is the one who sets the tone for the global monetary policy and markets expect it to cut aggressively next year, which should put some pressure on ECB’s President Christine Lagarde.

United Kingdom: The last of the major central banks to cut in 2024?

- The Bank of England holds its final policy meeting of the year on 14th of December, and another pause is on the cards. Governor Andrew Bailey and MPC members remain reluctant to discuss rate cuts, preferring to highlight that rate-setters would be willing to hike again should inflation return. Wage gains are still considerably what is consistent with a 2% inflation rate and despite a recent fall, headline inflation remains above target.

- November’s inflation report showed that UK inflation fell to a two-year low, strengthening the view that interest rates have peaked. Consumer prices rose 4.6% from a year earlier, down sharply from the previous point of 6.7% and the lowest since 2021. The fall was largely driven by lower energy prices, with gas costs falling by 31% and the cost of electricity dropping by 15.6%.

- Looking in to 2024, it is unlikely that the BoE will be able to contemplate rate cuts anytime soon, with an easing cycle currently looking unlikely until the second half of next year.

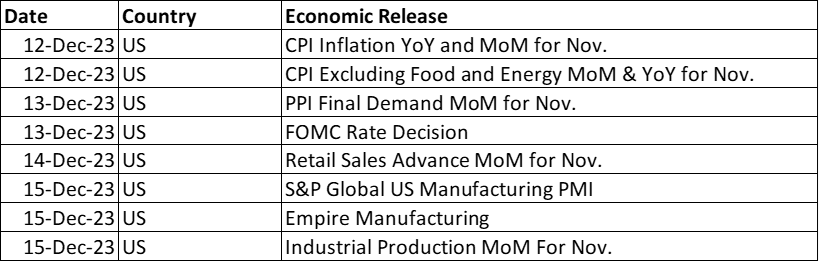

United States: Expectations of a recession still exists, but less and less likely.

- The Federal Reserve gets ready to meet for the last time this year, on the 13th of December, where no changes to the current policy are expected. At their last meeting, rates were kept unchanged although there was some hawkishness among the policymakers as we have heard in many speeches throughout the month. This time though, the central bankers’ tone should sound different but still conscious of having to keep rates at higher levels for some time.

- With US Inflation starting to cool and as the country’s growth starts to get closer to the rest of the world, the door for rate cuts begins to open for the Fed, which ultimately could take the crown off the US Dollar from a yielding perspective. Traders have now priced in 125 basis points of cuts for 2024.

- PCE Deflator – Fed’s preferred gauge for inflation- was flat MoM in November, lower than 0.1% consensus, and versus the prior 0.4%. YoY, down to 3.0%, versus prior of 3.4%.

- Labour market data recently presented a major risk to the loosening bets that have been put in place by traders. Non-Farm Payrolls, released on the 8th of December, showed that 199,000 jobs were added to the economy, stressing how strong and resilient the US economy remains to all the tightening that was put in place through 2023.

- In addition, the unemployment rate also fell to 3.7%, versus an estimate of 3.9% by economists, which many economists believe to be the hawkish indicator, and not the NFPs. We believe this set of data came to underscore the Federal Reserve’s intent to keep interest rates higher for longer, and that the market pricing for rate cuts may have gone too far.

CURRENCY PAIRS: What is next?

EUR/USD

- On EUR/USD the momentum remains bearish, especially as the outlook for the euro area looks more daunting than the US’, leading the pair to close last month on red. We have dropped quickly from the 1.10’s to trade below 1.08, and we have been consolidating around this level. The market is trying to push the pair to remain above 1.08 and head towards the next region of 1.09 where we find the imminent resistance around 1.0920.

- First resistance sits at 1.0920, followed by Key resistance at 1.1065.

- First support sits at 1.0755, followed by key resistance at 1.0660.

- The path for the pair is uncertain as we enter the new year. Besides economic data and growth, much will depend on who cuts rates first, the Fed or the ECB, and economists expect it to be a close call.

Source: Bloomberg

Source: Bloomberg

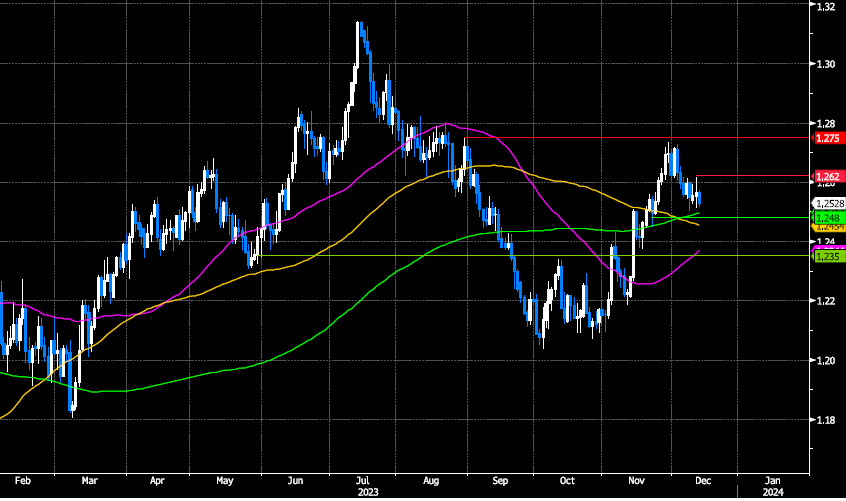

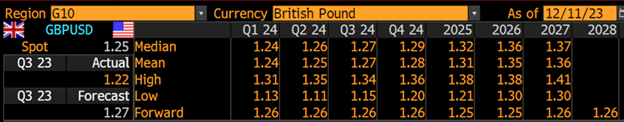

GBP/USD

- GBPUSD rallied at the start of November, prompting some analysts to update their forecasts, with some suggesting a move to 1.30 as the greenback lost ground against its peers. Our FX Markets Update’s analysis found the rally proved to be short lived, with the pair struggling to hold on to gains above 1.27.

- Markets remain wary of the timing of any rate cuts from global central banks and recent hawkish sentiment from the BoE suggest that there may be a case for additional GBP strength in the coming months.

- First resistance sits at 1.2620, followed by Key resistance at 1.2750.

- First support sits at 1.2480, followed by key resistance at 1.2350.

Source: Bloomberg

Source: Bloomberg

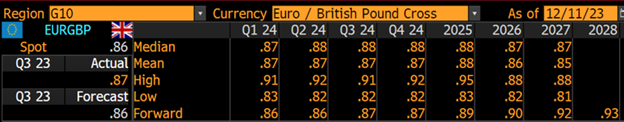

EUR/GBP

- The sterling could benefit from the lag in activity and growth from the euro-area in the medium term. In addition, if we compare both currencies from a central bank spectrum, the BOE has proven to be more hawkish than the ECB, committed to maintain rates higher for longer, giving sterling a yielding bonus compared to the common currency.

- The pair has dropped as much as 2.3% since Mid-November until the beginning of December, dropping from near 0.8765(Nov.20 High) to 0.8553 (6 Dec. Low).

- First resistance sits 0.8668, followed by key resistance at 0.87.

- First support sits at 0.8550, followed by key support at 0.85.

Source: Bloomberg

Source: Bloomberg

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.