FXbeacon: Tailoring FX Hedging Strategies

My sisters and I on our boat on Lake Geneva in Switzerland.

I. Intro

Life is full of unpredictable events. I was born in one of the most peaceful countries on earth, Switzerland, but 20 years ago I was fleeing war in Burundi, my mother’s country, after a rocket bounced off our roof and exploded the neighbour’s house on Christmas Eve. Thankfully, he was spending Christmas with us and was unharmed. We then moved to Thailand, where my dad’s wish to see monkeys at the Burmese border meant we were inland and saved from one of the worst tsunami disasters in human history—again around Christmas.

I know this looks like quite the dramatic life, and you could call me unlucky—or lucky for surviving both—but all of it makes more sense once I explain that my father’s job is to deal with wars, natural catastrophes, and make sure people are safe in such events. This has led me to live in 12 countries so far (Switzerland, Mexico, Peru, Pakistan, Sudan, Burundi, Thailand, Kenya, Senegal, Singapore, France and England).

Most of my life has therefore been spent in countries most people would consider dangerous or unstable, but much like the FX hedging strategies I now advise clients to adopt, we also mitigated risks by hiring security, living in specific neighbourhoods, and going to specific schools.

Unsurprisingly, some of these countries have volatile and restrictive currencies due to instability. I remember once going to the east of the Democratic Republic of the Congo, just a few hours’ drive from Bujumbura, and seeing people buy items like a tomato for a million or more in local currency due to hyperinflation. On the other hand, I came from a country with one of the most stable currencies in the world, the Swiss franc.

I could not help but wonder how a business owner could guarantee they could pay their operating expenses and suppliers with such an unstable currency. Today in the Congo, they use the US dollar alongside their local currency, the Congolese franc, and tend to prefer the use of the dollar for most transactions. This is not unlike other countries with hyperinflation, like the famous case of Argentina.

This has led my curiosity and drive to work as an FX broker at GPS Capital Markets, as economic stability is key in preventing conflicts and being prepared to deal with the unexpected.

In a business the same is true. Understanding your exposure, tailoring, and setting up an effective strategy, and simplifying monitoring and reporting for your exposure is key to avoiding losses, securing margins, and avoiding the unexpected as much as possible. Therefore, how do you do all that?

My mother, my brother, my sister and I enjoying a walk in Bangkok, Thailand.

II. Understanding your exposure and the risk

Understanding your exposure often seems complex but it really comes down to asking yourself two basic questions:

- What is your functional currency?

- What other currencies do you use in some way or form?

If you are a French company with offices in Germany, the UK, the US, and Australia, but you also have suppliers from China and Mexico, you have multiple exposures.

First, you need to pay your employees in the UK, US, and Australia in their local currencies. You also have operating expenses, and taxes, to pay in these countries. Revenue from these countries might be repatriated to France as well. On the other hand, you also have direct exposure in Chinese yuan (CNY) and Mexican pesos (MXN) with your suppliers in China and Mexico. Once, you understand where your exposure is, you then need to evaluate the risk.

Let’s start with payroll. For many companies, payroll represents the largest budgetary expense item. When your payroll is exposed to currency risks, this can pose massive challenges for the business. If you take a French business with no hedging strategy whatsoever in 2022, labour costs for just their US entity would have increased by close to 20% just for that year.

At GPS, our FXpert platform offers you tools to monitor your past transactions in all entities through one centralised platform. This allows you to understand the risks and potentially make use of our intercompany solution to net the amounts in each pair going in or out of each entity, reduce the overall amount you are exposed to, and also the volume of transactions. That means fewer risks, for a much lower cost. You can learn more about our IC Netting solution here.

III. Setting up effective FX hedging strategies, tailored to your needs

Payroll is quite an easy expense to hedge. Most businesses set a budget for the year ahead per team and region and can easily set up a one-year fixed forward at the date payment is sent to employees. This allows the business to secure a fixed rate for the year, it gives them a clear forecast of what to expect in terms of costs, and they can, therefore, adjust accordingly to avoid any unpleasant surprises.

The same is true for payments to suppliers. If you own a French business, for example, and you know you are selling a product for x length of time and will need supplies for y amount of time from China. You know the negotiated prices, shipping costs in CNY, and maybe USD for the shipping costs (giving exposure to different currencies here). Depending on demand, you may or may not need to buy more or less products from your supplier. Many tools are at your disposal here:

- A fixed or window forward to either pay at specific dates or have a “window” for payments

- A credit line with or without collateral, depending on your financials to facilitate the payments, is often used in parallel with the forwards

- Options to deal with unfavourable market conditions or exceptional market conditions compared to what was forecasted, or to deal with uncertainty (amount of goods needing to be purchase, or duration of the availability of the product you are selling).

All these tools can be personalised, tailored to match your specific requirements, and most importantly, offer you certainty, reassurance, and mitigation of the risks you have identified. All of this can be done with our Cash Flow Hedging solution, and you can learn more about it here.

IV. Simplifying monitoring and reporting

One of the hardest parts in managing your FX exposure is being able to efficiently and accurately understand your exposure and the performance of the tools you are using (or not using). This is often a task and can be immensely time-consuming if you do not have a team dedicated to it.

As we saw with the examples previously, managing your exposure is all about understanding what the risk is, and you can only understand the risk if you can see it.

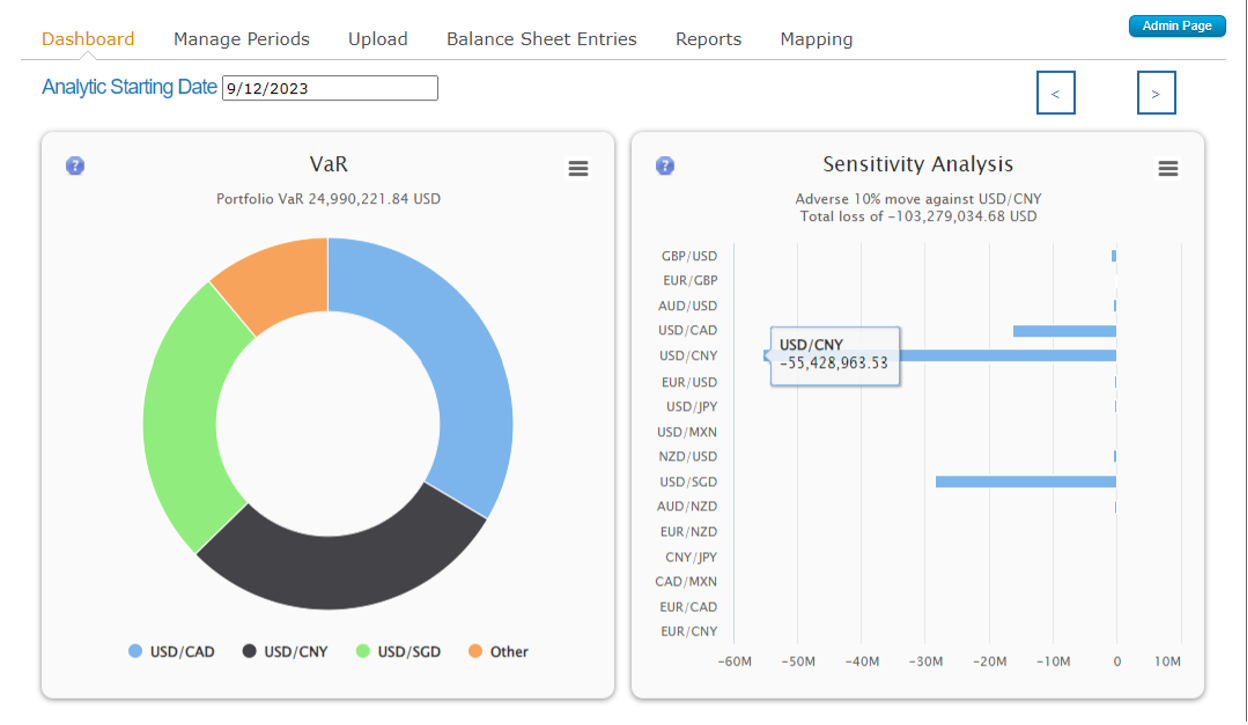

FXpert® is our cloud-based platform and won the Global Finance 2023 award for “Best System for Assessing Risk and Hedging Strategy”. The platform can connect to your existing ERP(s) and accounting software so you can input and compare forecasted and actual exposures, aiding in the optimisation of cash flow hedging programs and providing a comprehensive understanding of global flows.

You can monitor your VaR (Value at Risk), CFaR (Cash Flow at Risk), Earnings at Risk (EaR), and can run it per entity, per currency, per region, and pretty much as you see fit for as long as you have the data for the parameters. It’s an immensely powerful tool to monitor your exposure.

From a reporting perspective, it is also capable of automating many entries you would typically have to do manually. You can set up the GL Codes for your all accounting entries, extract, and upload the information through a centralised platform.

V. Conclusion

In navigating the complexities of global business operations, ensuring stability amidst uncertainty is paramount. The journey outlined here, from personal experiences in volatile regions to professional insights into FX just underscores the critical importance of proactive risk management with FX hedging strategies. At GPS Capital Markets, our commitment is to empower businesses with the tools and strategies necessary to thrive in an ever-changing landscape.

In today’s dynamic business environment, the ability to mitigate currency risks is not just a strategic advantage—it’s a necessity. Reach out to us today and embark on a journey towards greater stability, resilience, and prosperity for your business. Book a call with GPS