Hedging Strategies for AUD: What’s been effective in the past year?

The last 12 months, characterized by sharp moves followed by a range-bound period in the AUD/USD, have left many corporate treasurers searching for the best way to hedge their currency exposures. This article analyzes the performance of various hedging strategies over the last year. To facilitate an accurate comparison, we’ve adopted a standardized approach: the corporate treasurer needs to buy 1,000,000 USD every two months starting on 1 November 2022, resulting in a total of six hedges.

ANALYSIS

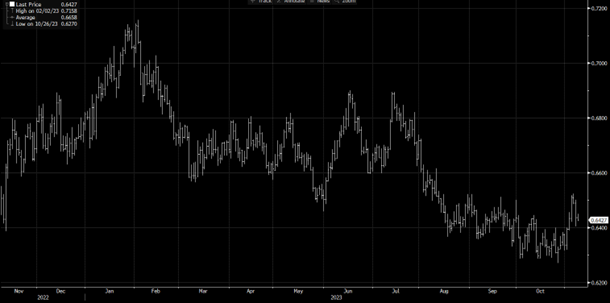

Before we start, let’s look at the history of the underlying market. The market is trading at 0.6420 after experiencing a 0.6270/0.7136 range over the period in question. The key drivers of the market have been monetary policy/yields, commodities (particularly the correlation with the main export of iron ore), and the recovery of Australia’s leading trading partner, China. As a ‘risk’ currency, the Australian Dollar has been impacted by global sentiment, equities, and of course, the conflict in the Middle East has also weighed on the currency pair of late.

Source: Bloomberg | AUD/USD spot market over the past year.

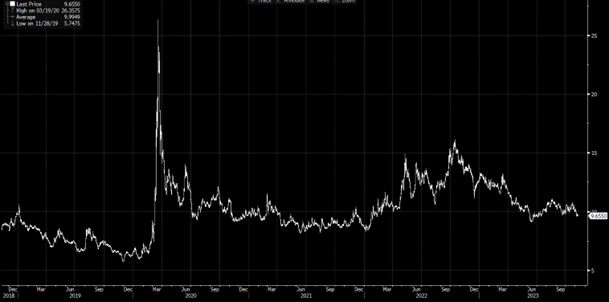

The implied 3-month volatility is currently trading at 9.7% after experiencing a high of 14.2% and a low of 9.1%. We examine this because it can offer comparative advantages to different strategies through enhanced hedging rates. This current level equates to just below the 5-year average of 10% and can be viewed as relatively neutral.

Source: Bloomberg | AUD/USD 3-month implied (traded) volatility over the past 5 years.

Strategy 1: Participating Forward

The Participating Forward gives the USD buyer / AUD seller guaranteed protection at a rate worse than the equivalent forward but, with this, gains the opportunity to outperform by benefitting from fifty percent of a favorable spot move (higher). The strategy is long volatility; therefore, lower implied volatility improves the protection level.

Outcomes

When comparing how this strategy has performed against the equivalent forward, only one out of the six outperformed. This strategy would have been worse than the equivalent forward hedges by USD 30,975, or on average -0.52%, for our USD 1,000,000 hedges.

Source: Bloomberg

The chart above shows the profit or loss of hedging with an AUD/USD Participating Forward compared to equivalent forwards. The lower section of the chart shows the spot market with the protection rates in yellow and effective exchange rates in green.

Strategy 2: Ratio Forward

The Ratio Forward is the reverse of the Participating Forward. It gives the USD buyer / AUD seller an improved rate compared to the equivalent forward, but if the spot moves in a favorable direction, they will be required to trade in double the amount. The strategy is short volatility; therefore, higher implied volatility improves the rate.

Outcomes

Three out of the six outperformed when comparing how this strategy has performed against the equivalent forward. Using this strategy would have been better than the equivalent forward hedges by USD 4,186 or, on average, 0.07% for our USD 1,000,000 hedges. This comparison uses a forward for the higher (leveraged) amount.

Source: Bloomberg

The chart above shows the profit or loss of hedging with an AUD/USD Ratio Forward compared to equivalent forwards. The lower section of the chart shows the spot market with the strike in yellow and effective exchange rates in green.

Strategy 3: Range Forward

The Range Forward gives the USD buyer / AUD seller protection at a rate better than the equivalent forward if the range holds. If spot trades outside the range, the protection rate moves to a level worse than the equivalent forward. The strategy is short volatility; therefore, higher implied volatility improves protection. This can be a smart way to play short volatility as it is only locally short. In this example, each 2-month hedge had ranges +/- 3% from the spot at interception.

Outcomes

When comparing how this strategy has performed against the equivalent forward, we can see that only two out of the six outperformed; however, this was enough overall to provide a positive result. Using this strategy would have been better than the equivalent forward hedges by USD 77,663, or on average 1.29%, for our USD 1,000,000 hedges.

Source: Bloomberg

The chart above shows the profit or loss of hedging with an AUD/USD Range Forward compared to an equivalent forward. The lower section of the chart shows the spot market with the ranges in blue and effective exchange rates in green.

Strategy 4: Knockout Forward

The Knockout Forward gives the USD buyer / AUD seller protection at a rate better than the equivalent forward; however, this strategy knocks out if the market moves against you (spot lower). The strategy is short volatility, and lower implied volatility improves the strike level. It should be noted this strategy is not a hedge but is often used to achieve an enhanced blended exchange rate. In this example, each 2-month hedge had barriers 3% below the spot at interception.

Outcomes

When comparing how this strategy has performed against the equivalent forward, five out of the six outperformed. Using this strategy would have been better than the equivalent forward hedges by USD 97,809, or on average 1.63%, for our USD 1,000,000 hedges.

Source: Bloomberg

The chart above shows the profit or loss of hedging with an AUD/USD Knockout Forward compared to an equivalent forward. The lower section of the chart shows the spot market with the strike in yellow, the barriers in blue and effective exchange rates in green.

CONCLUSION

The results of this exercise are interesting to observe, but it is important to note that all results are in the past, and there is no guarantee of future performance. Back-testing results can also vary according to the dates and parameters used. What is important is that hedging is periodically analyzed and adjusted where necessary.

Out of the four strategies, number 3 (range forward) looks to be the most appealing on a few fronts:

- Backtesting results are favorable.

- Gives clear protection levels.

- Chance to outperform and this can be tailored.

- Ranges are clear to define; 0.6520 has been apparent resistance over the last 3 months, and 0.6270 is the low for the year with some support ahead of 0.6000 expected.

- With many offsetting risks, the currency pair has experienced many periods of consolidation.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.