Natural Hedging vs. Financial Hedging: Navigating Currency Volatility

When we talk about managing currency risk, two approaches often come up: natural hedging and financial hedging. At their foundation, they are two different strategies for tackling the same problem: protecting your business from fluctuating exchange rates. Here we’ll break them down, using some real-world scenarios to help illustrate how companies deal with this challenge. Whether you’re running a multinational or a small business expanding overseas, understanding these tools is crucial to managing your bottom line.

What is Natural Hedging?

For finance leaders, business owners, and directors, the concept of natural hedging can sound like an elegant solution to the constant fluctuations of foreign exchange markets. It appears to offer cost-saving benefits by aligning currency inflows and outflows, but closer inspection reveals some hidden pitfalls that could undermine the expected financial benefits.

Natural hedging involves strategically managing a company’s foreign currency transactions, like payables and receivables, to ensure they offset each other within the same currency. In theory, this would allow businesses to avoid currency conversions entirely, shielding them from exchange rate volatility. A well-executed natural hedging strategy can be broken down into two essential steps.

- Step 1: Receive Foreign Currency Payments — Similar to the opening moves of a well-rehearsed dance, collecting your receivables first gives you a buffer of foreign currency, reducing immediate exposure to market fluctuations.

- Step 2: Pay Foreign Suppliers — Next, you use the foreign currency you’ve received to cover payments to suppliers, thereby avoiding unnecessary currency conversion. When these two actions are performed in sync, it can create a natural hedge that minimizes risk, much like a perfectly timed dance routine.

In simple terms, natural hedging is when businesses adjust their operations to minimize exposure to currency fluctuations naturally. In one example, a US-based company with substantial European sales might opt to open production facilities in Europe. By earning and spending in the same currency, the business reduces the impact of exchange rate volatility.

In another example, a US clothing manufacturer sells heavily in the Eurozone. Instead of producing everything in the US and dealing with perpetual USD-to-EUR exchange risk, they open a factory in Germany. Now, they can pay their local employees and suppliers in euros while also receiving their sales in euros. This natural hedging strategy shields the company from exchange rate swings between the dollar and the euro, ensuring their costs and revenues are in the same currency.

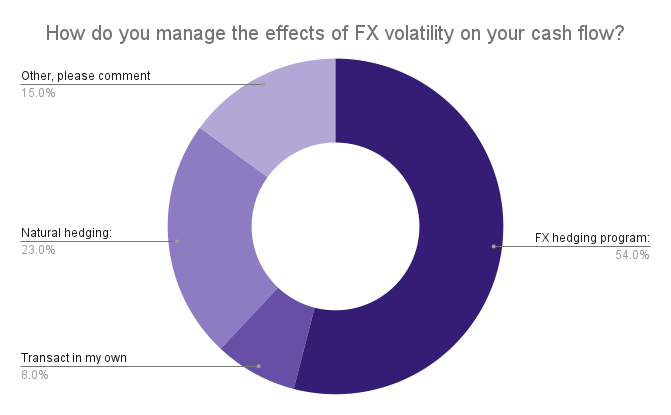

Interestingly, a recent poll we conducted showed that 23% of respondents rely on natural hedging to manage FX volatility. This approach is particularly appealing to companies expanding into new markets and needing to align revenues and expenses in the same currency.

- FX hedging program: 54%

- Transact in my own currency: 8%

- Natural hedging: 23%

How Financial Hedging Works

In contrast, financial hedging involves using financial instruments, like forward contracts or options, to lock in exchange rates for future transactions. While natural hedging adjusts business operations, financial hedging focuses on leveraging market tools to mitigate risk.

Let’s say there’s a UK-based electronics company that imports components from Japan. They have a large payment of ¥50 million due in six months. Rather than risk potential yen appreciation against the pound (which would make the payment more expensive), the company uses a forward contract to lock in today’s exchange rate. With financial hedging, they secure a fixed exchange rate, ensuring their future payment won’t exceed their budget due to unfavorable currency movements.

Financial hedging not only locks in exchange rates but also provides businesses with a safeguard against unpredictable market movements. Unlike natural hedging, which relies on aligning internal operations, financial hedging can be customized for specific exposures and timeframes. This approach ensures companies aren’t left vulnerable to sudden currency shifts that could erode profit margins. For example, by using a forward contract, businesses can guarantee a set rate for their foreign transactions, protecting them from adverse market changes that might occur between the time of placing an order and making the payment. This proactive strategy offers peace of mind, allowing finance teams to budget with confidence, knowing that exchange rate volatility won’t unexpectedly inflate costs.

As the donut graph above shows, 54% of companies actively use FX hedging programs, reflecting a clear preference for financial hedging when it comes to managing cash flow in uncertain times. These tools offer flexibility, especially in unpredictable markets.

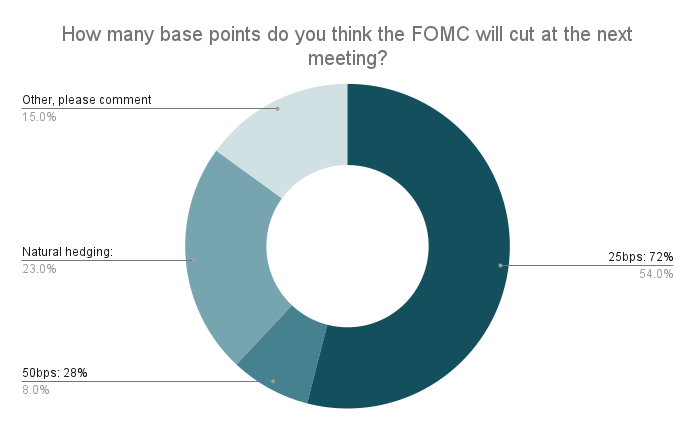

The Federal Reserve’s Role in Hedging Strategies

Speaking of market unpredictability and their role in hedging strategies, it’s impossible to ignore the role of central bank policies. A recent poll asked, “How many base points do you think the FOMC will cut at the next meeting?” with 72% predicting a 25-bps cut. However, on September 18, the Federal Reserve surprised markets by cutting rates by 50 bps—something that was not predicted by our LinkedIn audience. This underscores the importance of having an expert with their finger on the pulse to make predictions and revise strategies at a moment’s notice.

Using the advanced automated features of FXpert, businesses can also react faster than humans to market changes. FXpert’s ability to monitor markets and lock in trades across time zones far exceeds manual capabilities, providing businesses with an edge in managing currency exposure.

- 25bps: 72%

- 50bps: 28%

The Dollar Index and Hedging Considerations

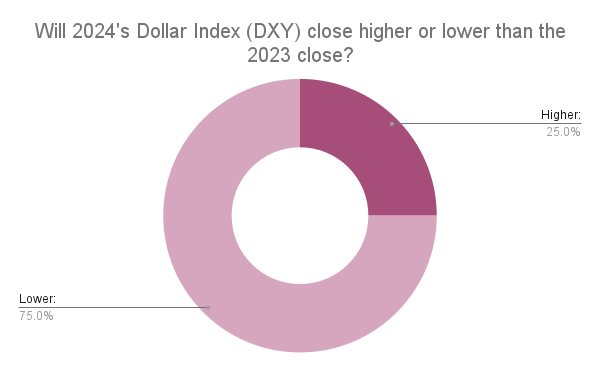

Another factor businesses must consider is the performance of the U.S. dollar. With the Dollar Index trading near 2024 lows, companies relying on natural hedging or financial hedging need to keep a close eye on these trends. A recent poll indicated that 75% of participants expect the Dollar Index to close lower than it did in 2023. A weaker dollar can lead to higher costs for businesses that import goods, making financial hedging a key strategy to safeguard against such volatility.

- Higher: 25%

- Lower: 75%

Choosing Between Natural Hedging and Financial Hedging

Ultimately, choosing between natural hedging and financial hedging depends on your company’s operations, cash flow, and tolerance for risk. For businesses looking for a long-term operational solution, natural hedging offers a straightforward approach to reducing currency exposure. However, if market conditions or transactions are more fluid, financial hedging provides the flexibility needed to navigate short-term fluctuations effectively.

Both strategies have their place, and successful companies often use a combination of natural hedging and financial hedging to optimize their exposure. Whether you’re expanding into a new market or trying to manage ongoing FX risk, understanding both approaches—and leveraging tools like FXpert—can help you make informed decisions and protect your business from unexpected currency swings.

The Value of GPS Capital Markets’ Expertise in Financial Hedging

When you decide to go the financial hedging route, GPS Capital Markets’ team of experts becomes an invaluable resource. Our experienced advisors not only help you craft a tailored hedging strategy that aligns with your business goals, but they also provide real-time insights into market movements. With access to advanced tools like FXpert, we can help you identify opportunities, lock in favorable rates, and manage trades seamlessly across global markets. Whether you need ongoing support or quick adjustments in volatile situations, GPS offers the expertise, technology, and service that ensure you’re always one step ahead in managing your financial risk.

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.