Polling Insights: Canadian Businesses Stay Flexible Amid Market Shifts

Trade and political relations in North America are centre focus for many business leaders around the world in January 2025, as the new Trump Administration announced pending tariffs against imports to USA from Canada and Mexico, sparking debates about how markets might respond in Q1. As treasury departments assess their hedging strategies and the future of operations in the region, data about currency values, expected rate changes, and proposed tariffs give decision makers give them more reasons to stay flexible in a turbulent business environment.

We launched three informal polls on LinkedIn in January. We wanted to gauge our community’s take on economic metrics and on politicians’ policies making waves (or not) in trading activities. Respondents in our community tend to include analysts, business owners, and finance influencers. These informal polls reflect moment-in-time thinking in our community. They are anecdotal and directional, and not to be taken as scientifically rigorous polling.

Looking at the Canadian Rate

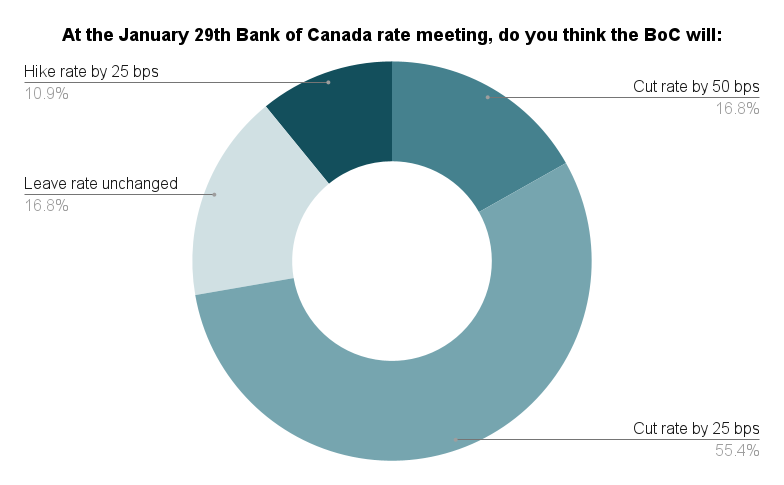

The Bank of Canada last cut its policy rate in mid-December 2024, by 0.50% to 3.25%. Respondents to our poll about the outcome of the January 29 RBC meeting predicted continued rate easing into February.

- Cut rate by 50 bps: 17%

- Cut rate by 25 bps: 56%

- Leave rate unchanged: 17%

- Hike rate by 25 bps: 11%

The majority of our poll respondents thought the rate would take another cut, with 56% choosing a 25-bps cut after the 29 Jan 2025 meeting. Our respondents were correct, with the 25 bps-cut going into effect in February.

The interaction between the BoC’s reading of the Canadian economy, proposed tariffs from the US on imports from Canada, and the outlook for the value of the USD/CAD is high on many analysts’ radar, providing clues about how Corpay clients might trade and might update hedging strategies in the near term.

Talking Tariffs and CAD Value in Q1 2025

When Corpay clients lay out their hedging strategies involving CAD this year, the macroeconomic factors currently on unsure footing will likely impact their decisions. The word on the tip of analysts’ tongues is ‘tariffs.’ Mark Allen, Senior Region and Project Manager at Corpay, says, “Tariff talk between the US and Canada will shape the direction of CAD trading relative to USD, but it’s a political hot potato.

“A read-through of the Trump Administration’s memo on trade and other commentary indicates that tariffs are a key part of the policy platform. And while they have been delayed, they aren’t derailed,” says Peter Dragicevich, Currency Strategist – APAC at Corpay.

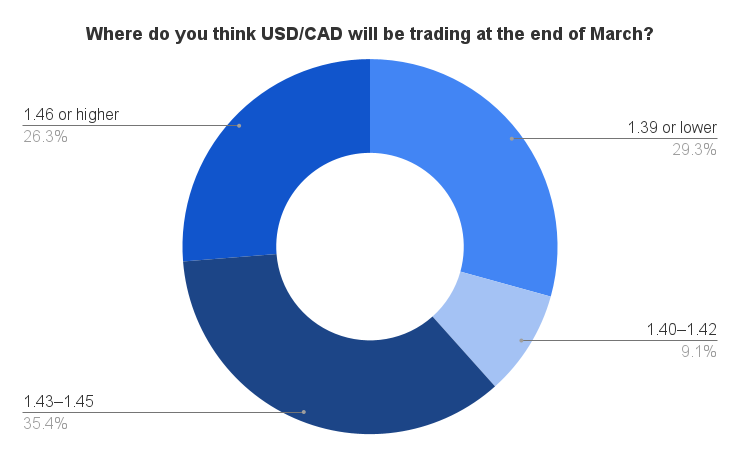

Our next LinkedIn poll also touched on broader ideas about forecasting what the value of the USD/CAD pair might be at the close of Q1 of 2025 in the midst of the back and forth between Canada and the new Trump Administration. We asked:

- 39 or lower: 29%

- 40–1.42: 9%

- 43–1.45: 35%

- 46 or higher: 26%

Sentiment among respondents to this question in our LinkedIn-poll was split, with most responses clustered between the lowest and highest choices for the USD/CAD value. This reflects the fluctuations in trade talks between the Trump Administration and Canada; many forecasters are reading the signals in polar opposite ways.

After analyzing a speech made by President Trump at Davos that reiterated tariffs on US imports from Canada, Karl Schamotta, Chief Market Strategist at Corpay, notes that the “Canadian dollar climbed even after the president reserved his harshest words for Canada.” Schamotta reminds us that “Canada accounts for more than half of total US crude oil imports… by helping to correct a period of overvaluation in the Canadian dollar, Trump’s threats may ultimately help Canada regain competitiveness in global markets: using purchasing power parity valuations, the Canadian dollar is now steeply undervalued relative to fundamentals.”

Trump’s aggressive stance and agenda provoke strong feelings – some for, some against – but the market’s responses are not easy to unwind. This might, therefore, make it challenging for businesses to create trading or hedging strategies in the near to medium term.

What Does This Mean for Businesses’ Hedging Strategies?

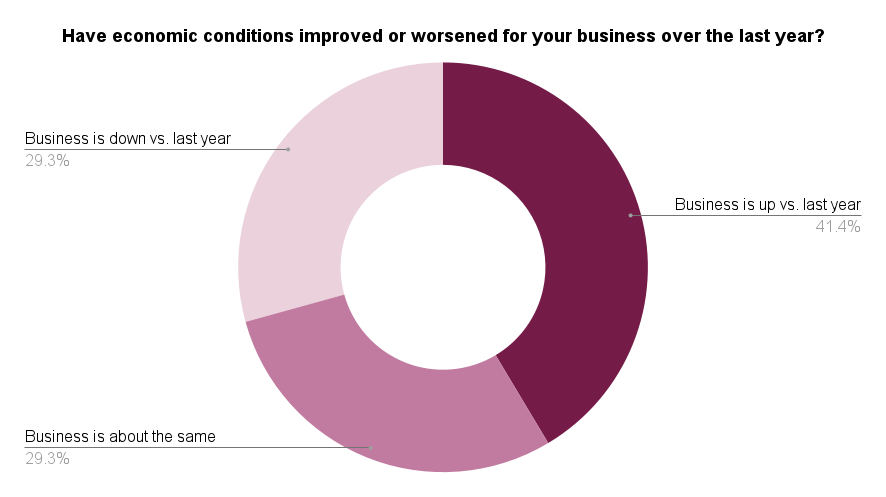

With numerous Corpay clients buying/selling CAD$ in exchange for other currencies and creating hedging strategies relative to CAD’s interaction with other currencies, our third poll on LinkedIn sought to understand poll-respondents’ broader evaluation of economic conditions during 2024.

- Business is up vs. last year: 41%

- Business is about the same: 29%

- Business is down vs. last year: 29%

General sentiment about business performance in 2024 is close to evenly split in results of this poll, though leaning slightly upwards.

We might see a different picture for Canadian businesses in 2025, with anticipated leadership changes in the governing Liberal Party, and an upcoming general federal election, likely to take place in 2025.

Chris Nicholson, Senior Vice President, Commercial Director at Corpay Cross-Border, works with Canadian treasury managers to help them to create hedging plans tailored to their individual business needs. Nicholson had this to say: “The general sentiment shared by many corporations throughout the Canadian economy is that in 2025 they will face ongoing challenges. The many recent rate cuts delivered by the Bank of Canada over the past year have been welcomed by most, as the BoC has tried to catch up with managing concerns about re-establishing confidence and averting a recession.

“Concerns that Canada may be faced with a recession in the near future have reignited due to threats from the Trump administration of delivering up to 25% tariffs on Canadian goods imported to the US. These concerns are further confounded with the bad timing of new Liberal Party leadership not arriving until March 24th, while the Trump administration continues to voice invoking tariffs as early as February 1st,” Nicholson added.

Staying Vigilant and Flexible with a Plan

The current volatility in the North American region, according to Nicholson, underscores why it can be helpful to develop and maintain a plan aligned to your individual business goals. Having a plan can help you be more proactive, and potentially increase optionality in the case of a seismic event.

When you develop a long-term relationship with a dedicated FX account manager, you can interface with a professional who understands the nuances and relative impact of market moves, and who can help you navigate through those impacts.

If you’re working to create a hedging plan to better manage potential market disruptions to the Canadian market, or to the North American region more broadly, reach out to a dedicated Corpay account manager here.

Corpay provides this document as general market information subject to: Corpay’s copyright, and all contract terms in place, if any, between you and the Corpay entity you have contracted with. This document is based on sources Corpay considers reliable, but without independent verification. Therefore, Corpay makes no accuracy or completeness guarantee. Corpay is not responsible for any errors in or related to the document, or for damages arising out of any person’s reliance upon this information. All charts or graphs are from publicly available sources or proprietary data. The information in this document is subject to sudden change without notice.