Polling Insights: The US Election’s Impact on APAC as FX Markets Brace for Uncertainty

As the 2024 US Presidential Election draws closer, global markets are preparing for potential shifts in foreign exchange markets. Recent remarks by former President Trump regarding trade policies, particularly his stance on tariffs for Chinese imports, have influenced the US Dollar Index (DXY). The question of APAC-connected trade is moving markets today, with FX traders on both sides monitoring the Harris and Trump campaign platforms for signals that could indicate market direction.

GPS Capital Markets offers expert insights from polling to keep you updated on FX movers and trends, helping you plan financial strategies with confidence. Let’s dive in.

The DXY Index and Trump’s Proposed Trade Policies

In mid-October 2024, the DXY Index recorded a 0.4% rise following former President Trump’s defense of his proposed tariffs on foreign imports. However, the dollar’s performance was mixed in the days that followed. The currency ended its 14-day winning streak with a 0.32% loss on October 18, before making a slight recovery with a 0.13% gain on October 21. The possibility of a Trump victory has fueled optimism for a stronger US dollar, as many anticipate that his policies would provide support for the currency. Trump’s proposed tariffs include a general 10% on all imports, with a more aggressive 60% tariff on imports from China, aimed at exerting pressure on China’s struggling economy.

In contrast, the focus on green energy and climate change in the Harris and Waltz ticket could align well with European priorities, translating to cooperation to compete with the Chinese dominance in the area. From an equity perspective, the green energy, technology, and healthcare sector could benefit from increased government support and investment.

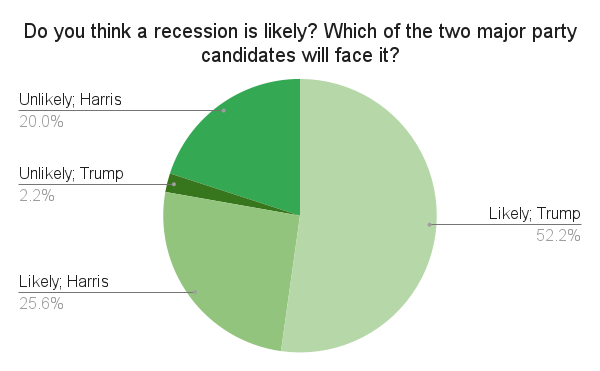

Concerns about recession and inflation are closely tied to the election outcome, influencing public sentiment. A significant portion of voters favor Trump’s tough stance on Chinese trade, believing that reducing reliance on imports from China could help stimulate the American economy. Recent polling data reflects the public’s mixed expectations for the economy:

- Likely; Trump – 47%

- Likely; Harris – 23%

- Unlikely; Trump – 12%

- Unlikely; Harris – 18%

These results suggest that many anticipate a recession regardless of the election’s outcome, with Trump’s stance on tariffs potentially contributing to economic uncertainty. His trade policies, which emphasize reducing Chinese imports, are seen by some as a necessary measure to revitalize the U.S. economy, but also raise concerns about economic disruption.

The Mexican peso has already felt the impact of Trump’s rhetoric, weakening by 1.7% against the dollar in response to his rising polling numbers and trade policy proposals. The peso reached its highest level since early September, at 20.0740 on October 21. With further declines expected if Trump’s trade strategies materialize, the peso’s devaluation could also affect other Latin American currencies linked to the U.S. economy.

China’s Economic Stimulus and Its Effect on Global Trade

China’s economic growth decelerated in Q3 of 2024, marking the slowest pace since early 2023. While consumption and factory output exceeded expectations last month, the real estate sector remains a significant hurdle. In response, Chinese authorities have stepped up policy stimulus since late September, though the specifics of the stimulus package and its long-term impact remain uncertain.

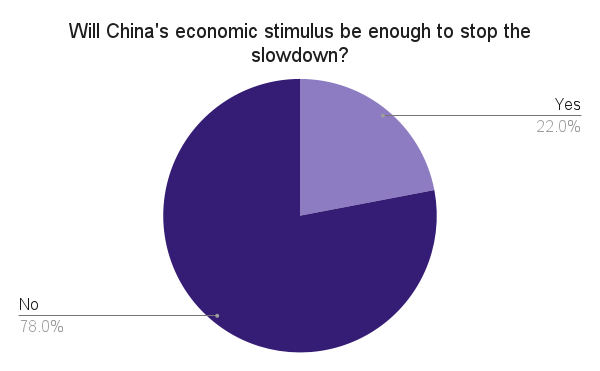

Our LinkedIn audience polls indicate that FX professionals are skeptical about the efficacy of the Chinese stimulus package:

- Yes – 22%

- No – 78%

The results show a predominant belief that the measures won’t suffice to offset the economic downturn. Should the US proceed with more aggressive trade policies, China might adopt a more assertive security approach. If decoupling efforts accelerate, the US may find it difficult to pressure China diplomatically, especially regarding contentious issues such as Taiwan.

Conversely, China could pursue a conciliatory strategy, offering to invest in American industries or negotiate export restrictions to lessen the appeal of anti-China policies in the US.

Australia’s Economic Outlook and Its Relationship with China

Australia’s trade ties with China have evolved significantly over the past decade. In 2013, Prime Minister Julia Gillard announced direct trading between the Australian dollar and the Chinese yuan, further cemented by the 2015 China-Australia Free Trade Agreement. More recently, in March 2024, China lifted tariffs on Australian wine, signaling improved bilateral relations.

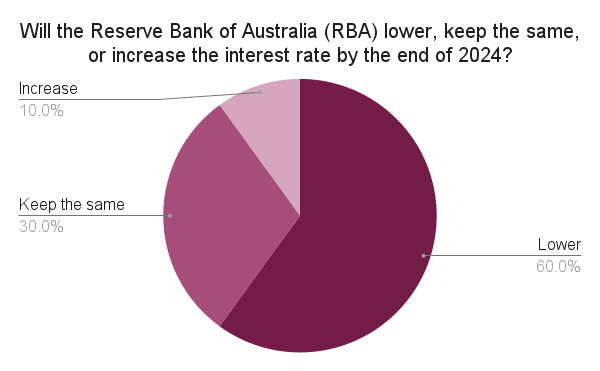

Market sentiment indicates that the Reserve Bank of Australia (RBA) will likely maintain the cash rate at 4.35% through the end of the year. A recent survey gathered opinions on the RBA’s upcoming monetary policy:

- Lower – 60%

- Keep the same – 30%

- Increase – 10%

The majority expects a rate cut, possibly in early 2025, contingent on economic data. However, if Trump’s trade policies escalate global tensions, Australia could face significant economic ramifications, given its reliance on exports to China.

An OECD report from May 2024 highlighted that Australia would be one of the hardest-hit economies if global trade declines. A 10% reduction in trade across OECD and non-OECD countries could cause a 1.2% GDP drop in Australia, with sectors such as mining, agriculture, and energy among the worst affected.

Implications of Chinese Tariffs on the Australian Economy

Should the US impose higher tariffs on Chinese imports, Australia’s economy could experience indirect effects due to its interconnected trade relationship with China. China accounts for approximately 36% of Australian exports, and any disruption in Chinese demand could impact Australia’s key sectors.

Australia’s vulnerability is especially pronounced in the mining and agriculture industries, with China being a significant export market for these commodities. The potential consequences of US trade policies on Australia’s GDP reinforce the need for economic diversification to buffer against external shocks.

Japanese Market Trends and Monetary Policy Outlook

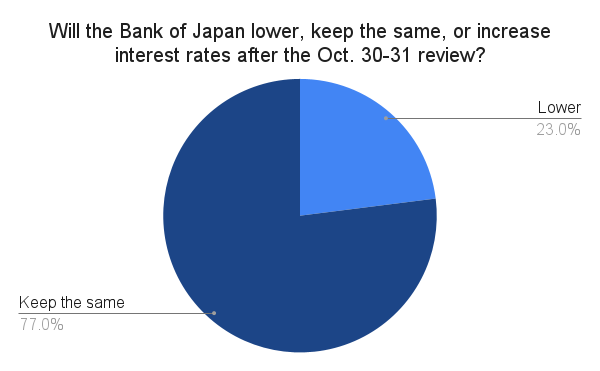

October 2024 has seen notable gains in Japan’s stock market, with the Nikkei 225 Index rising by 2.45% and the broader TOPIX Index up by 0.45%, driven by a weaker yen that benefits exporters. However, uncertainties linger regarding monetary policy, as the Bank of Japan (BOJ) is expected to keep rates unchanged in its upcoming review:

- Lower – 23%

- Keep the same – 77%

BOJ policymakers have indicated a cautious approach to interest rate hikes, aiming to avoid stifling growth amid global economic risks. As the US Federal Reserve potentially shifts towards monetary easing, Japan’s import costs could decline, alleviating some inflationary pressures. However, wage growth remains uncertain due to ongoing concerns about the US election and slowing demand from China and the US.

Broader Implications for APAC FX Markets

The 2024 US Presidential Election introduces significant uncertainties for FX markets, with potential repercussions for trade policies, economic growth, and monetary policy across multiple regions. The evolving economic landscape in China and policy decisions by central banks in Australia and Japan add layers of complexity to FX polling and market predictions.

FX markets could see heightened volatility, especially if the US adopts more protectionist trade policies. The interconnectedness of global economies necessitates a cautious approach for FX professionals, who must consider geopolitical risks and central bank policies while navigating market shifts.

Conclusion

As global markets brace for the outcome of the 2024 US Presidential Election, the effects on APAC’s FX markets will likely be shaped by policies surrounding trade, tariffs, and economic stimulus. Trump’s proposed tariffs on Chinese imports could exacerbate an already struggling Chinese economy, with indirect effects on Australia’s GDP and Japan’s export outlook. FX polling data suggests widespread skepticism regarding the effectiveness of current economic stimulus efforts in China and the trajectory of monetary policies in Australia and Japan.

For navigating these complexities, GPS Capital Markets offers actionable FX trading advice tailored to businesses’ needs. Their FX trading platform, FXpert, simplifies processes such as international payments, intercompany netting, and balance sheet hedging. By providing a comprehensive suite of tools, GPS Capital Markets helps businesses effectively manage currency risk and stay ahead in a rapidly changing global environment.