Polling Insights: What Caused August 5th’s Market Meltdown and is a Recession Coming?

In the ever-fluctuating world of global finance, the FX market stands out as a barometer of economic health and geopolitical dynamics. Recent events have underscored the critical need for experienced guidance in understanding and responding to FX market volatility. At GPS Capital Markets, we recognize the value of having seasoned experts in your corner, offering insights and strategies to hedge against unexpected shifts and safeguard your investments.

Our commitment to leveraging expert analysis and real-time data ensures that clients are equipped to make informed decisions, even amidst the most challenging market conditions. Through targeted polling and deep dives into market trends, GPS provides the knowledge and tools necessary to navigate the complexities of currency exchange and mitigate risk effectively.

A Multifaceted Market Meltdown

On August 5th, the financial world was rocked by a market meltdown that sent shockwaves across the globe. Markets tumbled as the S&P 500 fell by 3%, and the NASDAQ dropped 3.4%. GPS’ clients felt the impact as Japan’s currency, the yen, strengthened by 2.4% against the U.S. dollar—a significant move in the foreign exchange markets that added to the day’s volatility.

Mark Allen, FX Trading and Derivatives, said, “While there is no unanimous reason for what sparked yesterday’s market meltdown, many are pointing to last Friday’s worse-than-expected jobs report. It wasn’t the year’s lowest payroll tally (114k gain in July vs. 108k gain in April), but when combined with the downward trend in inflation, it did complete the lowest Core CPI/Payrolls duo in the current rate era, in line with Fed’s dual focus on inflation and labor.”

He further laid out the many stand-out fluctuations in August 6th’s Market Brief:

- U.S. 10-year yields traded to 3.665%, its lowest since June of last year.

- The probability of a cut at the FOMC’s September policy meeting reached 245%, equivalent to 61.25 basis points.

- The U.S. Dollar Index reached 102.16, a 6-month low.

- Flight to safe-haven JPY (USDJPY was -4.88 JPY at the low, 8-month low) and CHF (USDCHF -1.45% at the low).

- Gold declined as much as 3.24%.

- VIX Index (equity ‘fear’ index) reached 65.73, its highest point since the COVID breakout in March of 2020 (85.47 high).

- Bitcoin was -16.39% intraday, surprising to some that it didn’t perform like a safe haven as some have asserted.

- Japan’s Nikkei Index declined 13.24%, its biggest one-day decline since 1987.

- USDMXN gained as much as 4.60% intraday, reaching 20.043.

Polling FX Industry Experts

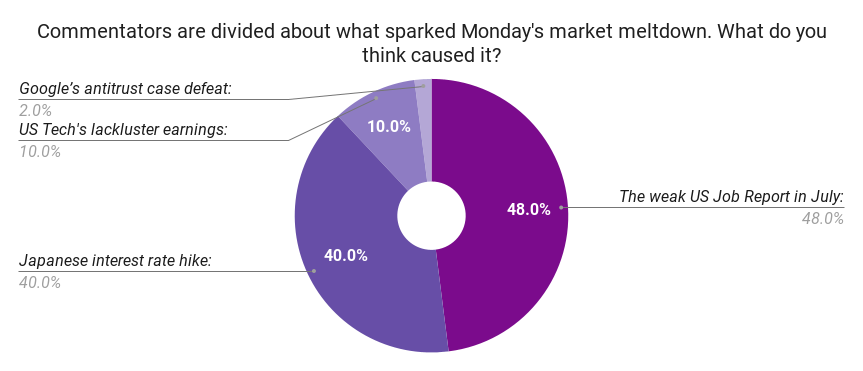

To unravel the forces driving this market chaos and the resulting FX market volatility, we polled FX advisors and experts on our LinkedIn page with the question:

- The weak US Job Report in July: 48.0%

- Japanese interest rate hike: 40.0%

- US Tech’s lackluster earnings: 10.0%

- Google’s antitrust case defeat: 2.0%

These results underscore that the weak US job report and Japan’s unexpected interest rate hike were perceived as primary catalysts for the market’s dramatic downturn, contributing significantly to FX market volatility. Ryan Oaks, Corporate Foreign Exchange Advisor at GPS, pointed out the broader implications of the August 5th selloff, stating, “The selloff extended globally, with Japan’s Nikkei 225 plummeting 12.4%—its worst drop since the 1987 Black Monday crash—sending shockwaves through financial markets.”

Background of the Meltdown

The U.S. job market showed signs of vulnerability prior to this meltdown. Reports revealed that the U.S. added only 74% of expected jobs in July 2024, with 114,000 jobs added instead of the anticipated 150,000. This significant shortfall heightened concerns about the economy’s health, as employment is a crucial indicator of economic stability and growth.

The poll results also reflect apprehension about Japan’s sudden interest rate hike, which caught investors off guard and exacerbated the market’s fragility. This move, perceived by many as an attempt to curb inflation, sent ripples through the financial community, leading to a sell-off that intensified fears about global economic health.

The Prospect of a Recession

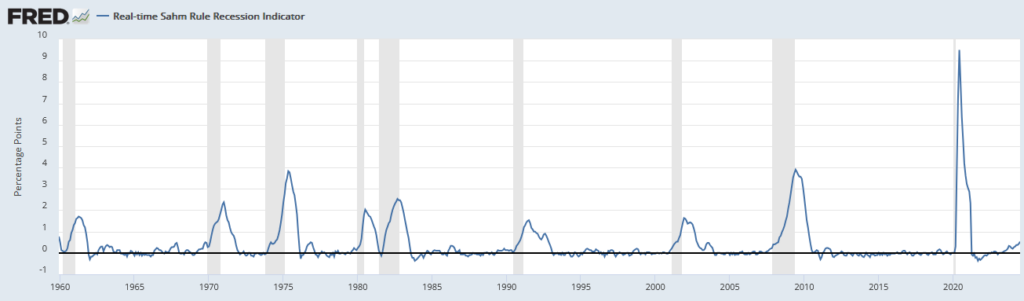

Economists have calculated that the Sahm Rule is now in play. This economic indicator, developed by economist Claudia Sahm, identifies the onset of a recession when the three-month average unemployment rate increases by half a percentage point or more from its low of the previous year. The recent rise in unemployment to 4.3 percent, the highest since October 2021, and the Real-time Sahm Rule Recession tool has indicated we may be nearing or already in a recession, as the graph below shows:

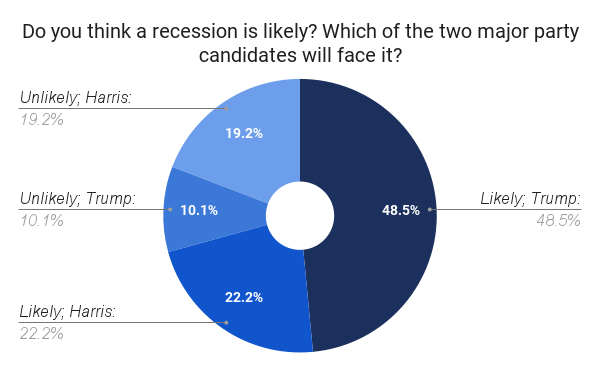

To gauge sentiment, we asked our community about the likelihood of a recession, given current economic indicators and the impending U.S. presidential election:

The responses highlighted the prevailing uncertainty:

- Likely; Trump: 48.5%

- Likely; Harris: 22.2%

- Unlikely; Harris: 19.2%

- Unlikely; Trump: 10.1%

With 77 votes cast and a total of 60.7% of participants saying they think a recession is “likely,” the sentiment suggests a significant portion of the financial community anticipates a bumpy ride ahead, irrespective of who wins the upcoming election.

Client Reactions

In response to the volatile geopolitical activity and its repercussions, GPS Capital Markets witnessed a surge of client inquiries. Many clients reached out to their advisors, seeking guidance to navigate the turbulent waters of the FX market.

Matt Marshall, Corporate Foreign Exchange Advisor at GPS, added, “During big market moves, I always rely on VIX to determine how worried I need to be. The VIX gives us insight into the implied volatility of the S&P500. Implied volatility, in simpleton terms, compares the expected market prices to actual market prices.” He continued, “On August 5th, 2024, the VIX reached a price level of 65.51. The last times we saw market volatility of this level was March of 2020 and October of 2008. I typically look at VIX & think of 21.10 & lower to be ‘safe’ market conditions with the typical swings of an efficient exchange traded market & anything above 25.75 to expect adverse market conditions.”

Volatile Geopolitical Activity and the FX Field

The recent events serve as a reminder of the significant influence that geopolitical activity can exert on the FX field and currency exchange rates. The intersection of political developments, economic indicators, and market sentiment creates a complex landscape for businesses and investors alike. Marshall further reflected on the uncertainty ahead, asking, “Should we expect market conditions to shadow the 2008 housing crisis, or the 2020 COVID outbreak? Those answers I cannot provide and only time has the answers we’re looking for. The only thing I know is that now is a good time to protect yourself or your organization against adverse market conditions.”

Understanding these dynamics is crucial for making informed decisions in the ever-evolving world of foreign exchange. As geopolitical tensions continue to simmer, the need for vigilance and adaptability in the FX field remains paramount. The right strategies, guided by experienced advisors like those at GPS Capital Markets, are essential in navigating these uncertain times.

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.