Polling Insights: Why Advisors Think Mexico Will Remain a Top Investment Hub

At GPS, we’ve started polling internal FX experts and others in the industry on our LinkedIn page. By tapping into the expertise of industry pros, we’ll provide insights into topics like currency volatility and the geopolitical forces shaping international investments.

With small samples of data based on informed points of views and highlights about the respondents, you’ll get introduced to different perspectives. For more in-depth analysis about market trends, subscribe to Market Watch.

First Poll: Navigating Resource Allocation Amid Global Manufacturing Shifts

In our first poll, we dive into one of the most pressing challenges for businesses with overseas operations: how to allocate resources amid the significant changes impacting major manufacturing centers, like Central America and the APAC region. Recent geopolitical shifts and economic developments have left multinationals grappling with where to invest and how to manage their supply chains effectively.

In discussions with GPS FX Advisor Jackson Craythorne and other industry analysts, we created our polling question to delve deeper into their observations that many businesses are anxious about investments in manufacturing and supply chains amid global conflicts and shifting trade policies.

The ongoing tensions in the South China Sea and the evolving trade relations between the United States and Mexico are crucial factors shaping strategic decisions. As these regions undergo rapid transformation, companies are looking for ways to navigate the complexities of global manufacturing.

Craythorne says, “Clients are concerned about how these shifts will impact their investment plans and future cash flows.”

We Asked

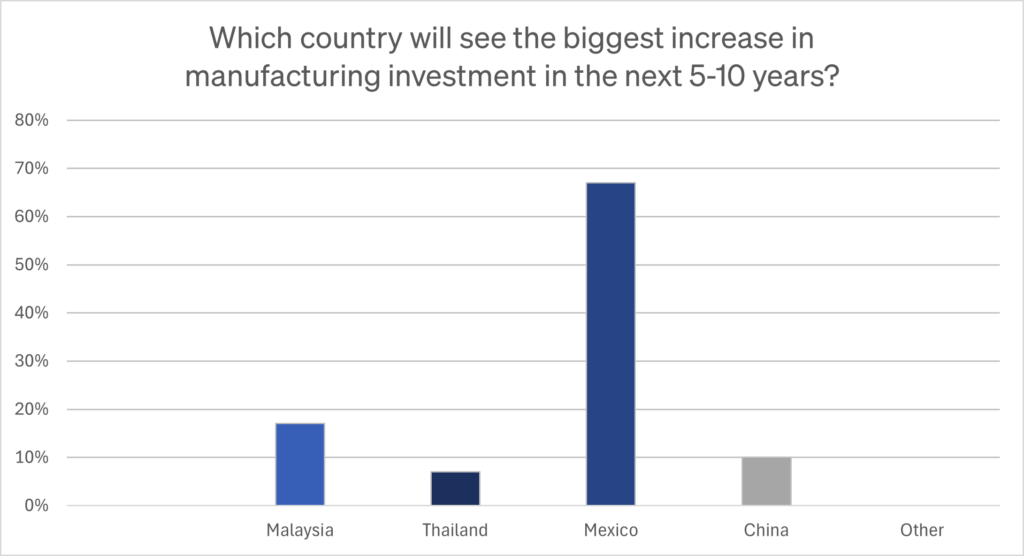

- Malaysia: 17%

- Thailand: 7%

- Mexico: 67%

- China: 10%

- Other: 0%

With 67% of respondents favoring Mexico, it’s clear that respondents still see the country as the next hub for manufacturing investment, despite mainstream journalists’ speculation that the policies of Mexico’s president-elect Claudia Sheinbaum and her vision for sustainable growth might tarnish investing zeal.

Mexico: A Leading Choice for Manufacturing Investment

One poll respondent, Gavin Boyack, a GPS FX Advisor, explains his choice of Mexico by pointing to the strengthening trade relations between the US and Mexico, bolstered by the USMCA trade agreement. He also notes the rising geopolitical tensions in the South China Sea, making China a less attractive option due to the increased risks and instability in the region.

Boyack highlights the appeal of nearshoring to Mexico, especially for industries like automotive, medical devices, machinery, electronics, household appliances, and textiles. The USMCA

agreement, along with Mexico’s growth in industrial infrastructure, has made cross-border trade more predictable and cost-effective. This, coupled with the US tariffs on Chinese goods and legislative support through the Inflation Reduction Act and the CHIPS and Science Act, has further encouraged companies to consider Mexico over other Asian countries.

“Mexico is now the United States’ largest trade partner. The attraction of Mexican Free Trade Zones and the operational efficiency of Maquiladoras have helped make nearshoring efforts more cost-effective to implement,” says Boyack. “We have seen that nearshoring manufacturing operations to Mexico has become the contingency plan for many industries.”

South China Sea Tensions Push Multinationals to Favor Mexico

The South China Sea has become a hotspot of conflict, driven by China’s assertive actions towards neighboring countries. As China, Vietnam, Taiwan, Brunei, and Malaysia all vie for maritime rights, and with recent measures like China’s 2021 order allowing the detention of foreign vessels, the region’s stability is increasingly in question. David Pierce, Managing Director at GPS, says,  “We are seeing signs of US clients moving manufacturing out of Asia, mainly due to the perceived political uncertainty and the logistics issues they faced during the pandemic.”

“We are seeing signs of US clients moving manufacturing out of Asia, mainly due to the perceived political uncertainty and the logistics issues they faced during the pandemic.”

This uncertainty has led many multinationals to reconsider their manufacturing strategies, often shifting focus to more stable alternatives like Mexico. Moving investments to Asia may not be appetizing due to the more significant language, technology, and cultural barriers that are still higher than those in the Americas. As companies prefer to keep their investments nearby, they should consider implementing cash flow hedging processes.

Essential Cash Flow Hedging for Currency Risks

As businesses navigate the benefits of nearshoring to Mexico, or going with other centers in Asia, implementing cash flow hedging strategies protects against fluctuations in currency. With the ongoing volatility and geopolitical uncertainties, expert advice and effective risk management will be important for maintaining financial stability and seizing new opportunities.

All companies that do business internationally experience the risks associated with currency volatility, yet many opt not to hedge. Such is the case with US businesses with payroll and imports from Mexico, who have seen their margins erode as the MXN strengthens against the USD.

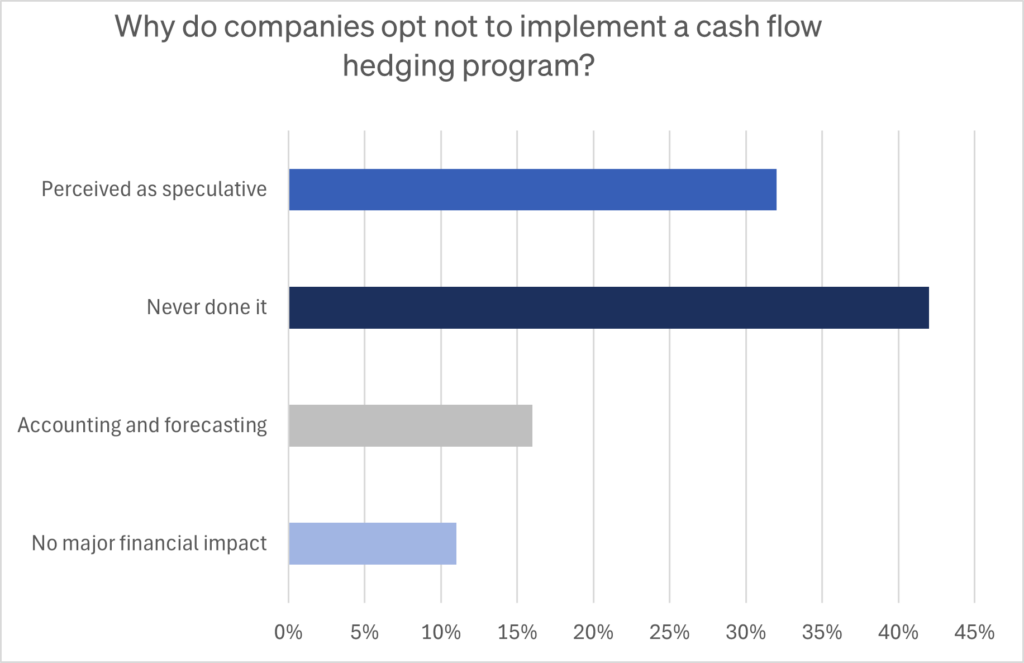

Our second poll sought to get more information about why companies do not implement hedging programs.

We Asked

- No major financial impact: 11%

- Accounting and forecasting: 16%

- Never done it: 42%

- Perceived as speculative: 32%

The results indicate more FX advisors think that companies (42%) have simply never implemented a cash flow hedging program, highlighting a gap in awareness and experience. Another notable insight is the perception of hedging as speculative, which deters 32% of respondents. Additionally, 16% of companies face challenges with accounting and forecasting, while 11% believe the financial impact isn’t substantial enough to warrant hedging.

Managing Currency Volatility

The peso’s volatility presents challenges for companies managing international cash flows. A hypothetical scenario illustrates the potential financial impact: a 10% weakening of the peso against the dollar could result in significant losses if exposures are left unhedged. As companies want to stick with Mexico and ride out currency fluctuations, it is even more important to implement more complex hedging strategies.

Check out GPS’ upcoming webinar for detailed information about setting up your program: FX Bootcamp: The Ultimate Guide to Cash Flow Hedging.

Conclusion

The poll results and expert insights underscore the importance of proactive financial management and strategic decision-making in the face of currency volatility and geopolitical uncertainties. Implementing cash flow hedging programs and seeking expert advice can provide companies with the tools and knowledge to navigate these challenges effectively. As businesses adapt to the evolving economic landscape, staying informed and prepared will be key to maintaining financial stability and growth.

For an analysis of your exposures and currencies mentioned in this article, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.